Read time: 4 min

👋 Hi there, happy Sunday!

It’s that weird time when days are really short, and you feel like you start your day in the dark and you end your day in the dark.

Today’s edition brings you VC and founder views on the current market.

🥞 Dry Powder !?!?

“We're in a holding pattern, no investing.", said a VC last week who I met in London.

Also talked to a few founders this week, who all said, it’s very hard to raise money right now.

Here's why it’s still the best time to build a company. It’s because of dry powder.

What’s dry powder?

Dry powder is money that investors raised and need to deploy.

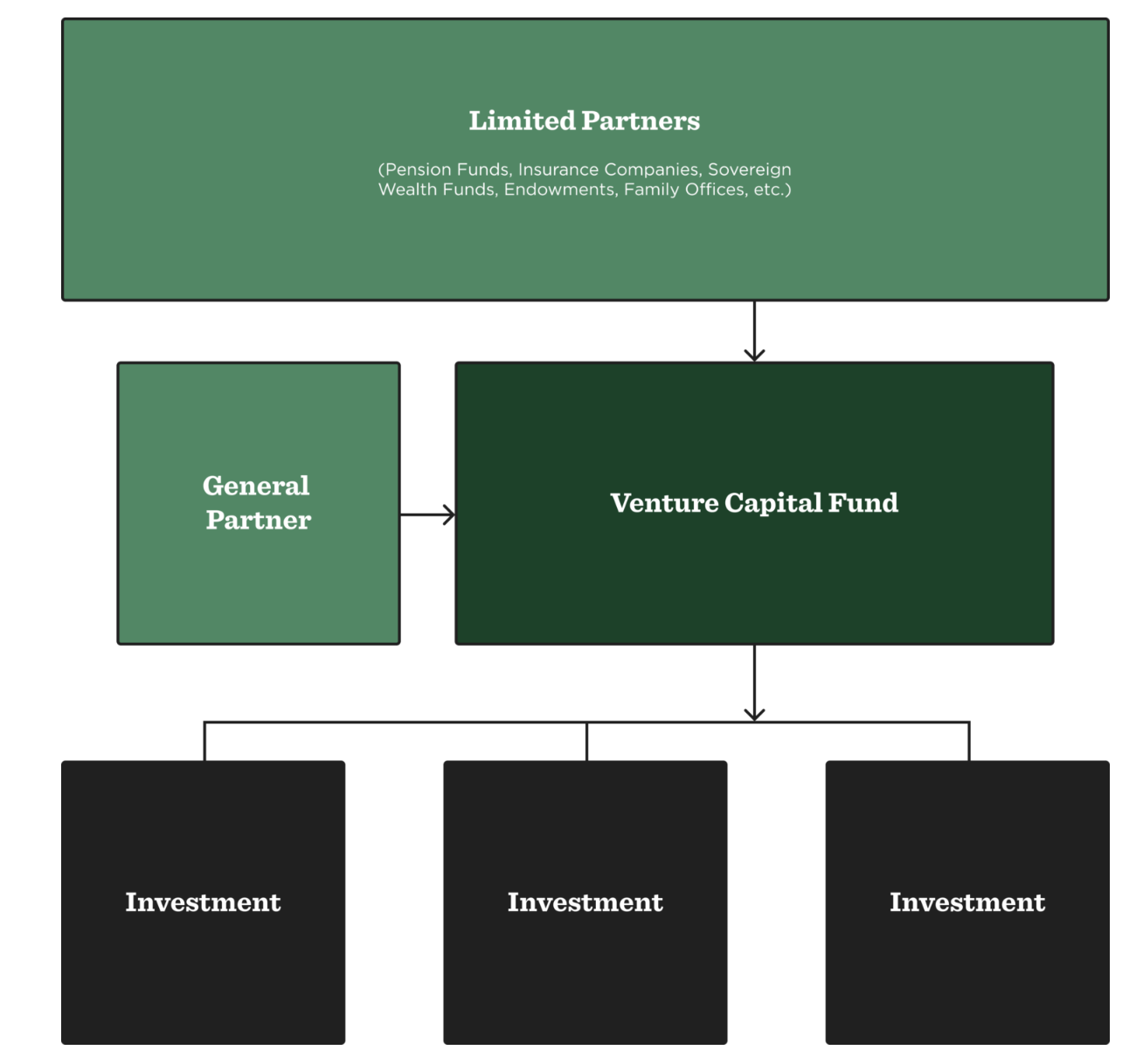

VCs and private equity funds generally raise money from their limited partners like pension funds, high-net-worth individuals and other institutions. See the image below via Visible.vc

As with any fund, they promise to deploy the capital and deliver a return within a certain timeframe. That timeframe could be 10 years. VCs like to call the launch year of a fund vintage.

What’s vintage?

According to Investopedia, "vintage year" refers to the milestone year in which the first influx of investment capital is delivered to a project or company.

In recent years, PE/VC has raised huge funds. Due to low-interest rates, money was cheap. But times have changed. Growth at all costs is over. Now it’s all about efficiency.

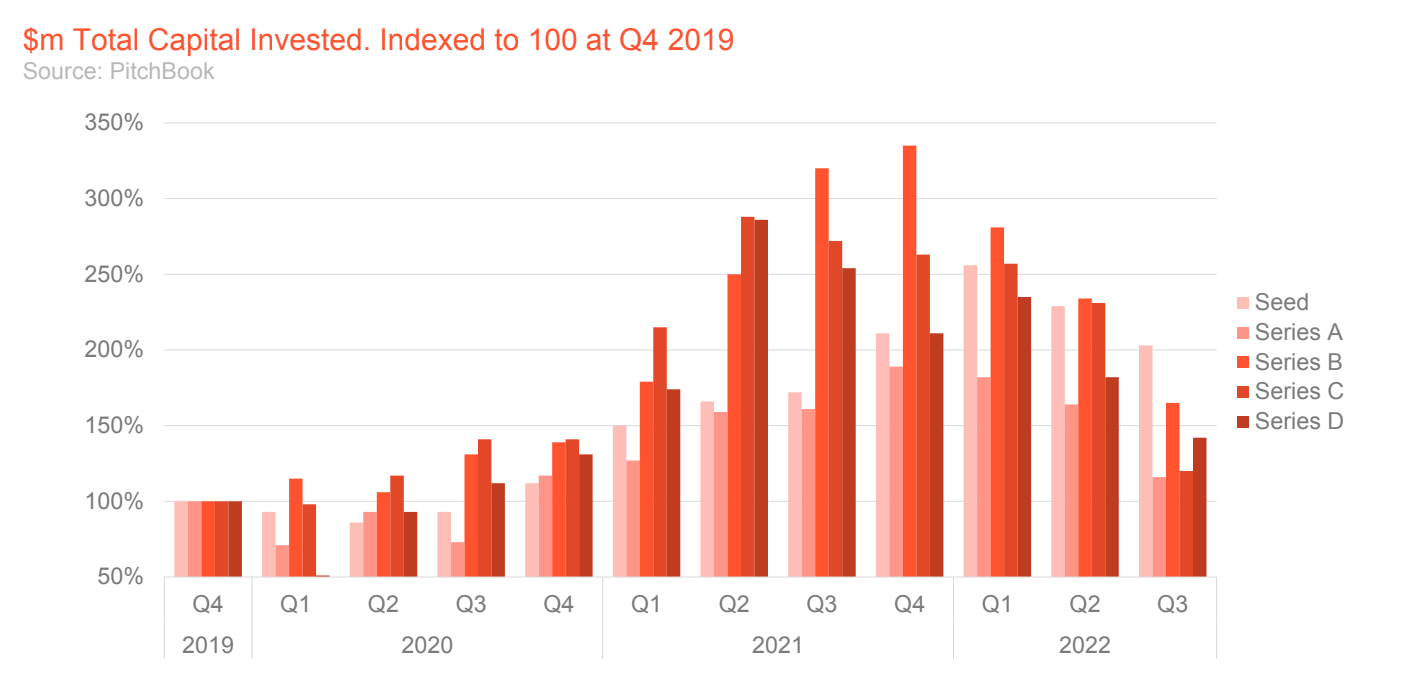

In the first quarter of 2022, US VCs raised more money for new funds than in the entirety of 2019, according to Pitchbook.

As a VC, the money that is raised needs to flow to startups. But from listening to founders on the ground, I know many VCs are in a holding pattern.

So what will that mean?

Investors are sitting on a huge pile of money. It seems everyone is waiting for the bottom of the market. But inflation is quickly eating away at the value of the fund.

Despite the public market downturn, war, inflation, and the cost of living crisis, VCs must soon break out of the holding pattern.

VCs have to invest it over a period of time to return their fund. But they're lagging behind in investing now. They will need to catch up on investing once the environment becomes a bit less volatile.

Great companies will be on the receiving end. That means there will be a massive wave of investment unlocked soon.

How soon?

My theory is in 12-18 months, markets will start to improve. For now, startups need to be extremely cost-conscious and manage their burn well to survive this critical phase.

Notable exception. Seed.

The notable exception here is seed money. It seems that funds in that category haven’t dried up as drastically as in later stages. See the below’s chart via Pitchbook and Frontline.

What should founders & startup leaders do?

As a founder told me this week, it’s extremely hard to raise right now unless you have stellar metrics. Even then, it’s hard.

What can you do?

run a tight ship (monitor spending, evaluate ROI, scenario planning)

watch your metrics (forget vanity metrics and project, focus on revenue)

drive customer value (protect the base, focus on the customer)

focus on your long-term vision (stay focused on the big vision)

adjust where needed (establish tight feedback loops to learn fast)

👀 What else happened this week

🙏 That’s it. Have a great Sunday!

If you enjoyed this: Subscribe!

🤓 Don’t know me? Here’s the about section.

My name is Semir Jahic.

More Value is my newsletter with lessons, stories, observations and analyses from my experience building a VC-backed B2B software startup and leading a high-performing sales engineering team.

More value is made for startup builders & sales engineering leaders.

But if you enjoy learning, want to work in startups and become an effective go-to-market leader, you’ll enjoy reading More Value too.