MV #003: 457x return. Not a figment of imagination.

Lessons, stories, observations and analyses on software sales, building companies and creating customer value.

Read time: 9 min (7 if you’re fast)

👋 Hi there, happy Sunday!

📦 What’s inside?

Thank you for subscribing. This is the weekly edition of More Value. You’ll get 4 things delivered directly to your inbox.

Curated highlights from thought leaders in B2B software

Lessons on how to become a better value seller

Analyses and observations from the B2B software industry

Unfiltered, personal stories from working in big tech and startups

🤔 LinkedIn Recap and My 2 Cents.

📈 Marginal gains in Sales

There are no cheat codes for creating value. Dominique Levin, CEO, Winning by Design (here) posted how marginal gains add up at scale. That’s true for all things in life, including Sales.

seven small improvements (like improving win rate from 20% to 22% or reducing discounts from 15% to 13.5%) will compound to doubling your revenue.

🪙 My 2 cents: I like this mental model. It’s the little things that add up over time. Drastic changes often drastically distract from the main goal. Improving little by little with tight feedback loops drives true improvement.

The flip side is also true: marginal loss. Getting a little worse every day. Picture this: a team discounting more to get deals done, lowering ASPs over time. Running fewer customer meetings in post-sales leads to lower adoption. Doing less QA when building a product ending up with complaints and churn.

It might not look like much at the start, but looking back, you’ll see a massive difference in performance. Marginal gains often make people think of getting better. But the tight feedback loop will also ensure organisations and teams don’t slack and get worse over time.

🎤 What salespeople can learn from failed startup pitches

Anna Farberov, GM, PepsiCo Labs, listened to 1000s of pitches and summarised top mistakes (here). In her opinion, these are the top 5:

Lack of personalisation

Lack of clarity

Defensive reaction to questions

Underestimating corporate complexity

Not taking no for an answer

🪙 My 2 cents: I was thinking, how does this relate to Sales? Here’s my take and if I agree.

Lack of personalisation.

I agree. You can’t pitch without knowing your audience and personalising the presentation. Generic demos by your sales engineer won’t win a deal, no matter how fantastic the product is. The same goes for your standard corporate pitcher deck. You have to personalise it. Every time. No exceptions.

Lack of clarity

I agree. I’ve seen many companies pitch their product, and I’ve pitched products countless times. You should 100% cover all your basics. Why are we here? What does success look like? How are we helping? Too often, it’s easy to get excited and not know if there’s even pain or need for something new.Reacting defensively

I agree. Handling objections is part of the job. You cannot get defensive. Questions and even objections are a good thing. It means people are engaged in your pitch. Take it as a chance to learn and understand how you can deliver more value.Underestimating corporate complexity

I agree. Being enterprise-ready is not easy. Not for go-to-market teams and not from a product perspective. It’s a whole different ballgame in many cases. You can avoid stress by acknowledging that and focusing on the segment where you can deliver value best.Not taking no for an answer.

I disagree. In her post, she calls out how despite a no trying to reach out to other executives creates inefficiency, waste of time and despair. For them, maybe. When you’re pitching, you’re doing your job. To win business, you have to go at it from many angles.

If you’re a salesperson taking no for an answer too easy means, you’re not doing your job. The same applies to startup builders. If you pitch a solution and the buyer says no, understand the no. Understand why no, why no now and what would need to happen for it to become a yes. Maybe it’s just a no from that one person. Perhaps that person is in the lower levels of the organisation and doesn’t have the whole picture.

I would not take no for an answer too lightly, whatever the situation.

🥞 Sunday Pancake Deep Dive

The massive value created by Figma

For those who missed it: Figma was acquired by Adobe ADBE 0.00%↑ this week for a stunning $20bn. Tomasz Tunguz, VC at Redpoint, asked if this is a change in the trend of how companies are valued or if this was an outlier.

The conclusion was pretty clearly: it’s an outlier. The economic environment for tech companies has not fundamentally changed. The median public company today is trading at a 6x multiple.

Adobe bought a fantastic company and paid for it for what it’s worth.

🍴Let’s dig into it.

What made Figma so special?

Figma is lightweight, cloud-based and built around collaboration, unlike Photoshop and the rest of the Adobe suite.

Product-led growth motion. (Read: what is PLG?). The pricing starts as entirely free for individuals and students. Later, as collaboration starts, the paid tiers kick in. Eventually, sales teams got overlayed to increase revenue from enterprise accounts.

Easy. Figma is one of the easiest-to-use products out there for teams. Whenever I used Adobe products, I would inevitably have to watch a bunch of YouTube videos to learn what I needed to do. Figma is different. Here’s from a G2Review:

“What I like the best about Figma is that the software is a universal tool for multiple purposes. On Figma I can wireframe, prototype, create a whole design system or just create social media posts. Figma is also very light, so you don't need a powerful computer to use i. Use Figma on a browser or download the software on your computer, both ways are great UX.”

They could have killed Adobe. From what I read, it seems like Adobe is a sophisticated, high-powered, feature-rich platform, but it’s unable to innovate as fast and win over the design collaboration space. Figma was different and proliferated.

Here’s what David Wadhwani, President of Adobe, said on the last earnings call.“To give you a sense of their scale and financial success, Figma is expected to add approximately $200 million in net new ARR this year, surpassing $400 million in total ARR exiting 2022, with greater than 150 percent net dollar retention rate. With a total addressable market of ~$16.5 billion by 2025, Figma is just getting started”

Adobe XD, Adobe’s in-house competitive product, doesn’t even get a mention on the last few earnings calls. Here’s Adobe’s suite and where Figma fits.

🌱 Figma’s beginnigs. A story of simplification.

Sean Whitney on Twitter shared a slide from the Figma fundraising deck. Figma made life easier for a whole lot of people, and that’s what makes it so valuable.

What’s interesting is the value was not created by transforming spreadsheets. That’s what many SaaS companies still do today. Think CRM, sales tech, CS tech and other solutions in the B2B space. They’re all replacing the glorified spreadsheet.

When we look at Figma, it’s another step in that evolution. They simplified what modern solutions couldn’t bring together. Cloud storage, asset creation, prototyping, handoff and version control. They’ve built Figma with collaboration front and centre.

I suspect many more innovative companies will emerge, disrupting the first generation of cloud-based applications.

Adobe could not have caught up to this. Why? It’s a huge company. When you dissect the setup of Photoshop and Adobe tools, you will see that it has not been built for real-time online collaboration. It’s easier to spend $20bn.

This excellent thread walks through the product-level differences that would have taken Adobe years to overcome.

💰VCs & some employees are making a boatload of money.

Adobe is buying Figma for $20bn, that’s around $40.20 per share. According to Ayk (link), these are the prices that investors initially paid with roughly estimated returns.

Index Ventures - $0.088 ➡️ 457x return

OATV - $0.088 ➡️ 457x return

Greylock - $0.199 ➡️ 202x return

Kleiner Perkins - $0.332 ➡️ 121x return

Sequoia - $1.098 ➡️ 37x return (actually, it was 45x as per the term sheet below)

a16z - $4.619 ➡️ 8.7x return

Durable - $21.29 ➡️ 1.9x return

According to CNBC (here):

The three venture firms that led Figma’s earliest rounds — Index Ventures, Greylock Partners and Kleiner Perkins — all own percentage stakes in the double-digits, people familiar with the matter said. That means they’ll each return over $1 billion

Bloomberg reported (here):

Sequoia put in $97 million in total and snatched a 6% stake in Figma, said a person familiar with the details. Sequoia’s stake is now worth $1.3 billion, and the single investment had a return exceeding the total value of the US growth fund it came from, the person said.

Here’s what signing that term sheet looked like. Tweet by Andrew Reed of Sequoia.

Congrats to the entire Figma team on creating something worth $20bn in about 10 years. Incredible!

💡 Quick Explainer: Wondering what the value of your startup options is?

Disclaimer: I’m no financial advisor. But I found this guide (here) helpful, and it’s ridiculously comprehensive. Slidebean CEO Jose Cayasso’s videos on YouTube are much easier to digest. Check it out.

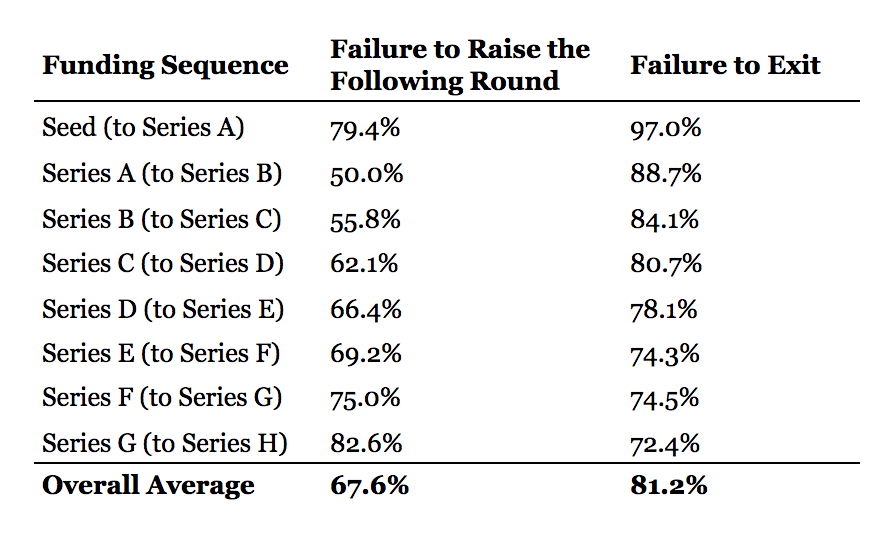

Figma minted dozens of millionaires with this deal. That is life-changing. Only a few startups ever create so much value and exit successfully. Any way you slice it, the likelihood of success is low. Extremely low at the Seed stage and low at the late stage. At the same time, the life-changing upside and the professional experience on the startup fast train are often worth the risk.

Check out this chart illustrating the success rate of startups at various stages.

Chart Source Medium (here)

🥹 Missed my posts week? - Fret not!

I’m speaking about the value of AE/SE partnerships in software sales at DEMOFESTx by Consensus in London. (Check it out here)

Work-Life Balance is overrated. (here)

Sales reps who work with cross-functional partners win. Here’s why. (here)

John Hodgson featured presales leaders in a solid article that helps you create a stronger LinkedIn profile. (here)

EQT raised a $1bn fund to grow European startups. (here)

🗞️ In other news

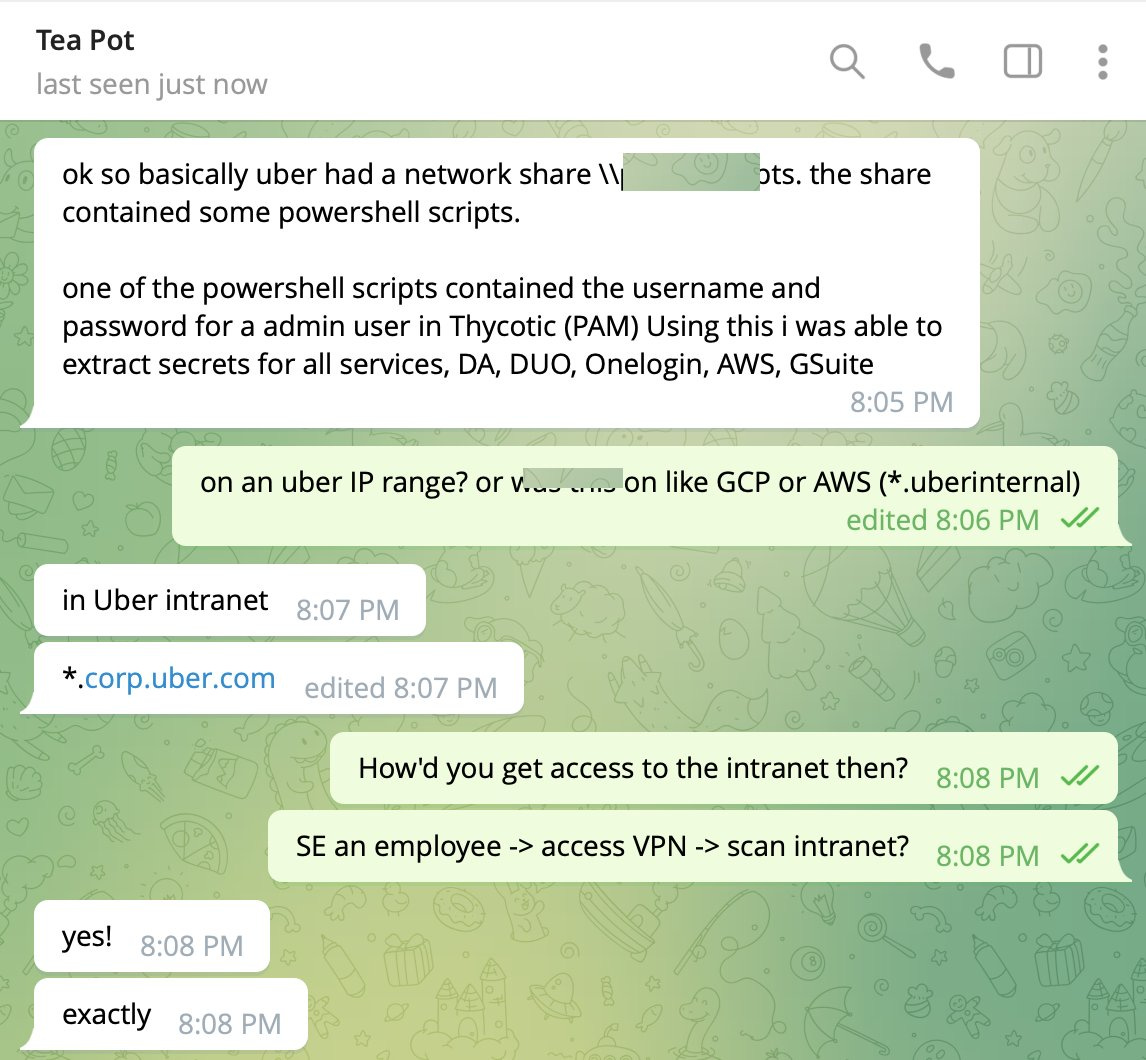

Uber got hacked by a teenager. Yep. The hacker left even left a note on Slack for everyone. Employees thought it was a joke. (link)

Apparently, this is how it happened (unverified). It all comes down to Social Engineering. The hacker exploited the weakest link in the security chain: Humans.

Patagonia founder gives away company to save the planet. What a legend! (here)

Podcast of the week. Check out this brilliant episode of Grit with Thomas Kurian, CEO of Google Cloud. What a great person. Fun fact. He’s not the only high-achiever in his family. His brother, George Kurian, happens to be the CEO of NetApp.

🤓 Don’t know me? Here’s the about section.

My name is Semir Jahic. I’m a self-confessed news junkie, and I’m also a student of startups and obsessed with what it takes to build something of value.

In More Value, I’ll share what I’m reading, learning, and observing to help you create more value.

More value is for go-to-market professionals in Sales, Customer Success, Delivery or anywhere in the enterprise software industry.

If that’s you, subscribe.

🙏 That’s it. Thank you for reading.

If you liked today’s edition, invite your friends. If you didn’t, let me know why.

Have a great Sunday!

Thanks for reading More Value! Subscribe for free to receive new posts and support my work.

Great insights and shares! I like catching up on so much in one place ☺️