MV #015: This Q4 is different. Time to rethink MEDDPICC.

The pressure is on for tech companies. That doesn't mean you should throw a good sales process out the window.

This is a weekly newsletter with tips, observations and analyses on building, growing and running B2B software companies. To receive More Value in your inbox each week, subscribe here:

👋 Hi there, happy Sunday!

It’s Q4, and many companies will finish their fiscal years in December or January. A few crucial weeks are ahead for go-to-market teams.

💰 More Value in Q4 - What it takes to win

It’s that time of year again. Everybody starts feeling the pressure. Tech startups on the VC train, in particular, have a few crucial weeks ahead of them.

Startups are always on the clock, VCs give them an amount of money which typically lasts about 18-24 months. In that time, they must prove value and achieve key milestones.

If they don’t, then raising the next round becomes a very hard conversation.

So, what’s happening at many startups in their go-to-market teams?

The struggle is real

Here’s what many go-to-market teams struggle with right now:

Pipeline generation

Pipeline progression

Customer retention

These are the old problems, and everyone knows about them.

So, what’s changed?

The world has changed in 2022

The cheap money party is over. Most companies are hesitant to spend more money on technology right now.

If they do, they are much more reserved and diligent about it. So, in addition to the old reasons for the struggles, you also get new reasons.

Old reasons

Holiday season is starting, and key stakeholders are harder to reach

Competitive pressures

Unclear decision criteria

The champion lacks power to get the deal done

Lack of awareness of the decision process and economic buyer

No compelling event

…

New reasons

Hesitation due to macroeconomic pressures

Deeper scrutiny of ROI and value

No authority with champions. Everything goes through CFO.

Indecision is your worst competitor

Buyers unwilling to spend large sums choosing the land & expand route

…

So, how should this change the behaviour of go-to-market teams?

SPOILER ALERT: It should not.

As always, people do stupid things under pressure, and one thing is, they throw a perfectly fine sales methodology out the window.

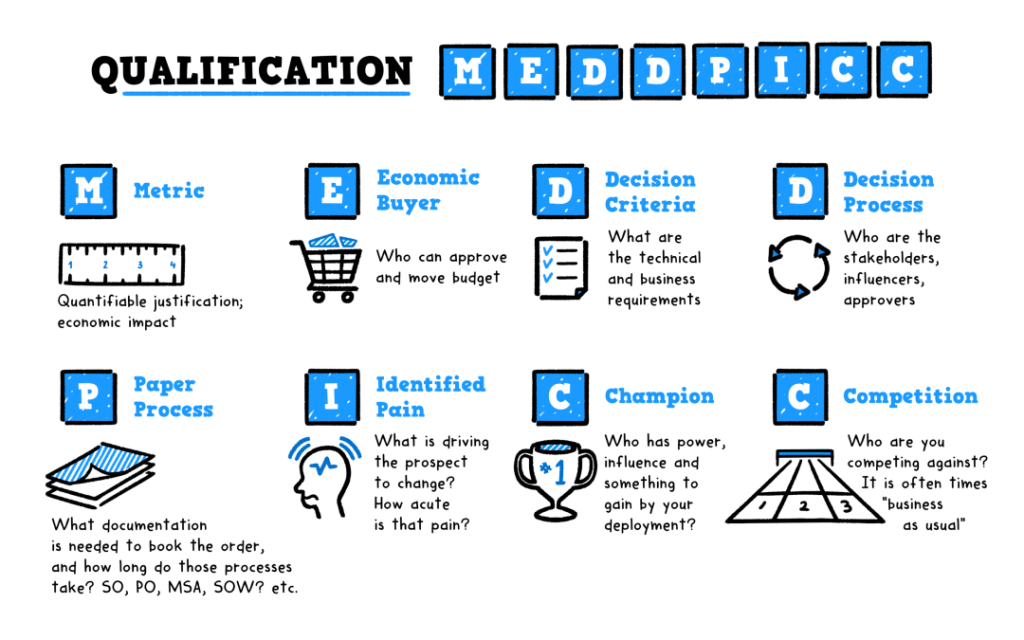

Trust the process - MEDDPICC

The macro has changed, and buyer behaviours have changed. But the essence of the process is the same.

MEDDPICC or whichever methodology you use, use it for this macro. Methodologies like this have been around for decades. They barely changed.

Why?

Because they stood the test of time.

MEDDPICC was invented in 1996. Tupac was still around, and the N64 was the most popular console on the market.

Unlike the N64, MEDDPICC is still a thing because it works. In good and in bad times.

You don’t need fancy new strategies to win in Q4. You need to focus on the process and run it like one.

Key considerations for MEDDPICC in 2022/2023

From my observations in the last few months at different startups, here’s what you need to rethink about your sales methodology to sell successfully in 2022/2023.

Metric

Selling based on productivity gains alone will not cut it. You have to save costs and articulate very well in your ROI/value assessment how you will deliver value.

Economic Buyer

If you haven’t talked to CFOs before, then now is the time. Finance will be involved in most of your deals now. Sell to finance to avoid disappointment.

Decision Criteria

In the past, it’s great to understand how you’ll help your specific buyer, the team that will use your software. Today, you have to also look at the big picture and understand the requirements of the overall business and how your solution will help.

Decision Process

In the last few years, a lot of hiring and firing has happened. Chances are you’re talking to a champion who has never bought software at their company. Get ahead of this and map out the decision process.

Paper Process

This is similar to the decision process. Every document is likely to be scrutinised today. SOW (Statement of Work)? Get your Professional Services team to explain the structure and costs. DPA (Data Processing Addendum)? Get your Security/Privacy team on a call to clarify any questions. Your Sales Engineers can help bridge that gap.

Identified Pain

No pain, no gain. Pain alone is not enough. The pain has to be acute and hurt a lot. Plus, you need a clear way of showing how you address the pain. If you can’t do that, you’ll struggle to get a deal done.

Get your Sales Engineering team involved to run in-depth discovery, map challenges to solutions and deliver value-packed demos that show a brighter future.

Champion

A Champion is great. Multiple champions are better. Don’t just rely on a single person to help you sell internally. Develop multiple champions and enable them as best as you can to sell for you internally.

Use marketing to create collateral. As for customer references, use your Sales Engineers to create tailored mini demos or videos, involve customer success to join a meeting and pitch the time to value journey.

Ideally, you have multiple stakeholders are the buyer in direct contact with several of your team members.

Competition

There are thousands of competitors out there. The price war will be real in Q4. But outside that, there will be the indecision competitor. It’s that murky grey zone that’s very hard to get out of.

If you follow the rest of MEDDPICC and especially focus on identifying pains, proving value and illustrating a quick time to value, you can produce action.

TL; DR

Trust the process, follow each step, adjust to the new buying environment and work as a team to win by delivering more value together.

✅ How to sell more software…

Unexpected customer feedback on my team member and why I shared it.

It’s official. You don’t need to be extroverted to succeed in sales.

🗞️ In LinkedIn & other news

On Venture Capital - “Business building is the marketing, but asset management is the business model.” by Kyle Harrison from Contrary

👉 My take: Good reminder that LPs pay VCs and how they make money is through fund management fees (often 2% and carried interest for returns agreed with LPs (often 20%).

On employee retention - To Retain Your Best Employees, Invest in Your Best Managers via HBR.

👉 Top Quotes:

“Managers — more than any other factor — influence team engagement and performance…70% of the variance in team engagement is determined solely by the manager.”

Now, employees rate their immediate supervisor as most important to understanding the organization and its priorities, above the executive team.

On great startups - I joined Demoboost as an advisor. Announcement here. Demoboost powers all revenue teams with tailored, high-impact demos to sell more, faster and bigger.

👉 My take: Do more with less is the new game in town. This also will apply to sales engineering / presales. Demoboost addresses that challenge.

On startup valuations - Startup valuations continue to plummet, especially at growth stage. Even amazing companies like Dataiku, Snyk or Checkout.com struggled and raised down rounds. It seems that seed round are somewhat more resilient.

👉 My take: Downrounds are not the end of the world. There’s a stigma but it’s not the end of the world. Great companies will thrive even in this environment.

On remote working - There is a slow reversal of remote working taking place. Top company CEOs who used to be very bullish on remote work are less optimistic.

👉 My take: Still too early to tell. But I’ve seen more news recently from leaders sharing that they’re concerned with remote employee productivity and are looking to establish at least a hybrid model. Time will tell.

🙏 That’s it. Have a great Sunday!

🤓 Subscribe if you enjoyed this

If you enjoyed this, subscribe below and connect with me on LinkedIn on Semir Jahic.