MV #018: 👊 Big Goliath vs. Small Goliath - Salesforce is getting more heat 🔥

👋 Hi there, happy Sunday!

It’s end of fiscal year season at many B2B tech companies. What a ride it has been and every leader is focused on planning for FY24.

So, let’s dive into this week’s edition of More Value.

💰 Big Goliath vs. Small Goliath

I recently wrote about Microsoft’s layoffs (here) and the epic battle between Salesforce vs. Microsoft (here). A side player in this is also the battle between Google vs. Microsoft (here) but let’s stick to CRM 0.00%↑ vs. MSFT 0.00%↑ for now.

⭕️ What they have in common?

Both have made layoffs recently to adjust to market conditions.

Both these amazing companies fight to win in the B2B market. -

Both have a strong foothold in the office application space. -

Both have amazing employees to build great products.

Both are well-established big players in the market.

Both have been around for over 20 years.

❌ But that's where most similarities stop.

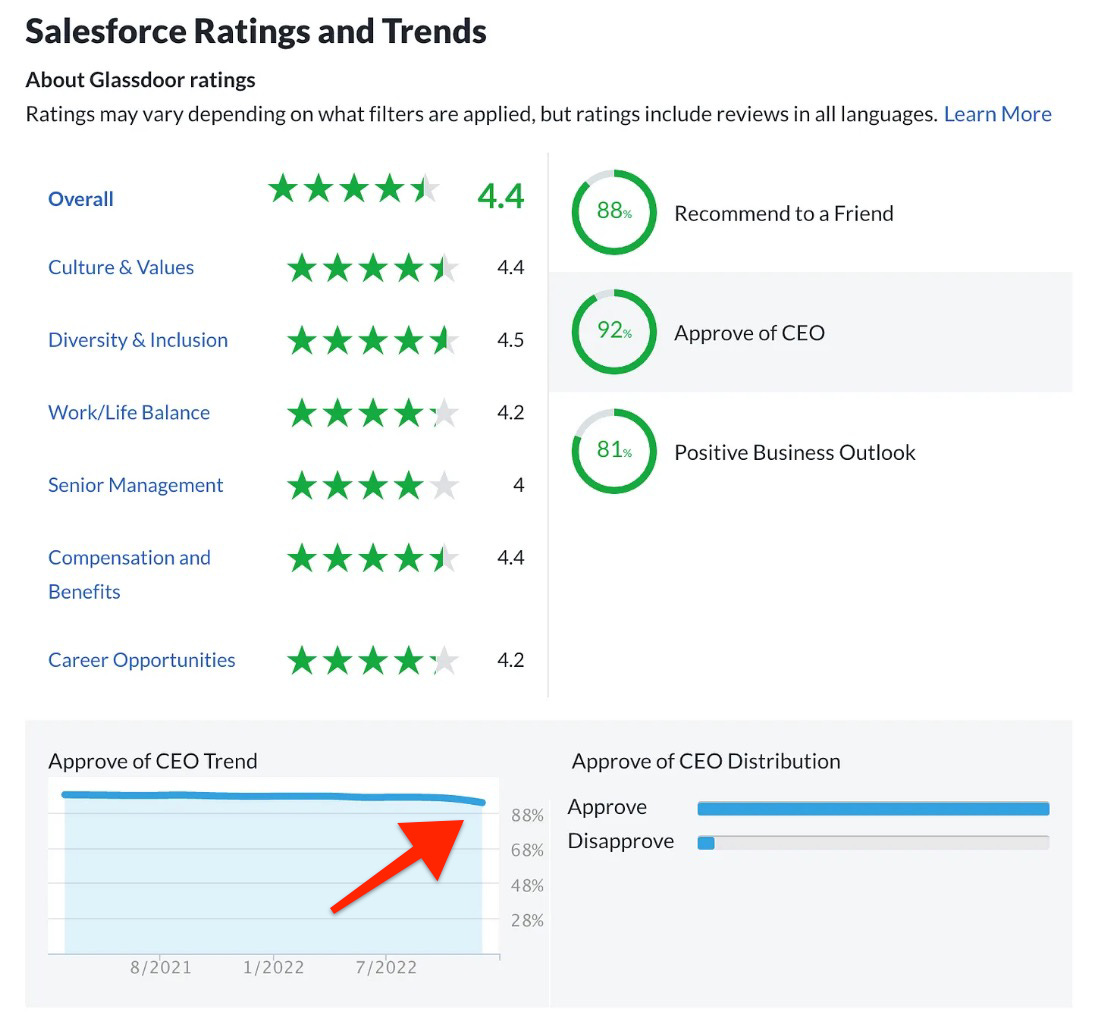

Times are changing now and the CEO approval is down slightly after the recent round of layoffs at Salesforce in early 2023.

Salesforce disclosed they had the activist investor Elliott Management take a multibillion-dollar stake in the company. Elliot Management.

"We look forward to working constructively with Salesforce to realise the value befitting a company of its stature."

Meaning increase profit margins by cost-cutting.

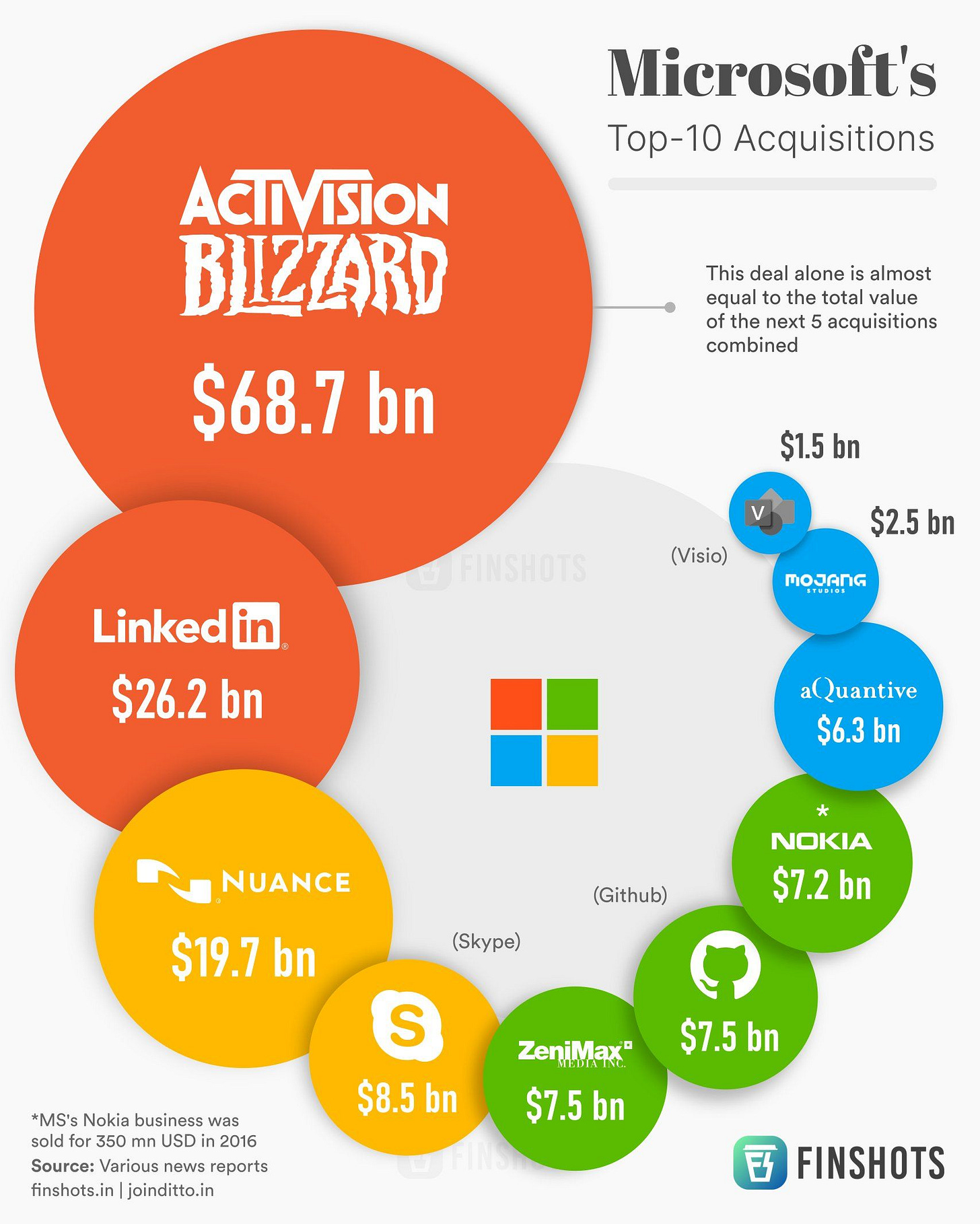

Meanwhile, Microsoft announced a multi-billion dollar investment in OpenAI to leverage AI across its product suite.

"In this next phase of our partnership, developers and organizations across industries will have access to the best AI infrastructure, models, and toolchain with Azure to build and run their applications." - Satya Nadella, CEO

Clearly one operates from a position of strength while the other is in a tough spot.

If things continue this way Microsoft will dominate B2B tech in the long run over Salesforce. Of course, Dynamics365 is no match for Salesforce’s core platform but by now the core platform is actually pretty small at Salesforce.

It’s mostly Sales and Service Cloud with a few add-ons like portals. The rest is a hodge-podge of integrations, half-baked re-platforming projects and completely disjointed data sources. That makes the company vulnerable because it will not unlock the value of the acquisitions the company made in the last years.

I’m not saying that Microsoft has much better capabilities than Salesforce, especially in the CRM space but Salesforce for far too long held a dominant market position and hasn’t capitalised on it.

Now, three activist investors have engaged, key executive including the Co-CEO have left and Marc Benioff needs a plan.

Microsoft is stronger than ever.

Why is Microsoft so strong?

Microsoft is one of the only big software companies that has successfully managed to completely re-invent itself and find a path back to greatness after a prolonged slump.

The company was founded in 1975, so it's been around longer than Salesforce, but investors, employees and customers are looking ahead, not back.

Microsoft won over the developer community, built a cloud infrastructure business and transitioned successfully to the cloud.

What’s up with Salesforce?

Salesforce has not got the same track record.

The company is still very much a CRM SaaS with failed or partially failed attempts to win over developers (Heroku), dominate the data community (Wave, Datorama, Tableau) or position itself as a leader in the collaboration category (Quip, Slack).

None of these has worked to diversify the portfolio and drive revenue successfully. The acquisitions are disjointed in go-to-market as well as product strategy.

What's more, leadership challenges to create a succession plan for Marc Benioff have failed twice with the Co-CEO approach. Microsoft has transitioned very successfully from founder CEO.

How will Salesforce address this?

Salesforce has to seriously work on getting back on track if the company wants to remain a leader in B2B tech.

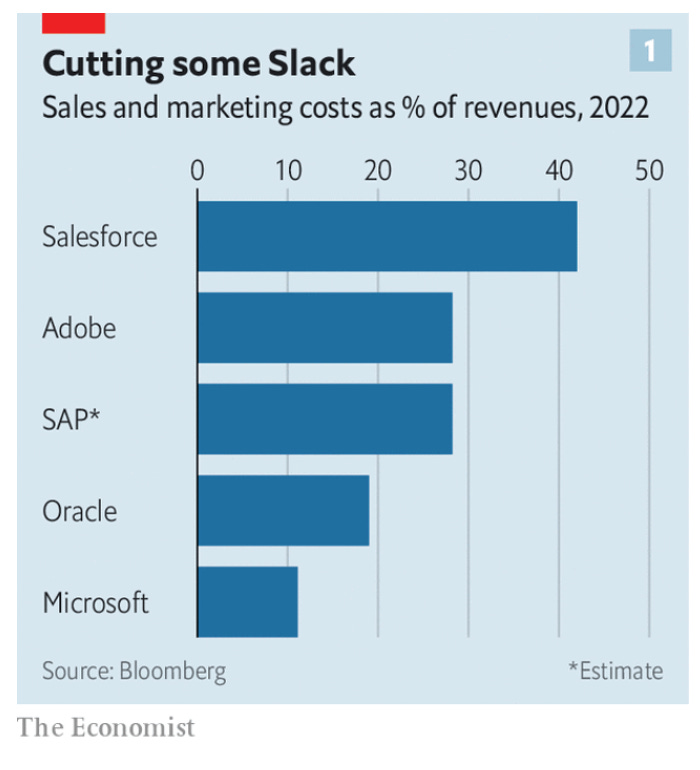

The Economist published (here) the Sales & Marketing costs as of % revenues for Salesforce and Microsoft. Salesforce spends 42% on S&M. 🤯

Compare that with low ~10% at Microsoft you can immediately see why investors are jumping on the opportunity to create more efficiencies.

Reuters already reported that the company as appointed new board of directors last week to support the changes.

👉 My take: Salesforce must address the issues and challenges quick.

Why not start with stop compensating a dozen people when a deal closes? Or why not sell off parts that never should have become part of the company like Slack or Tableau?

Most importantly, the company needs to get the S&M spend down drastically which probably leaves additional layoffs on the table for the coming weeks and months.

All this has already been asked for by activist investors. A cautionary tale from Microsoft should serve as guidance.

Whether or not other tech giants follow Apple’s and Microsoft’s conciliatory example, they may be realising that the activists aren’t going away. - The Economist (28 Jan 2023)

Rather than seeing these as foe, Salesforce should think of them as friend. Or shall I say, member of the Ohana.

If not, Microsoft might win in the long run.

📉 What dropping valuations mean for startup employees

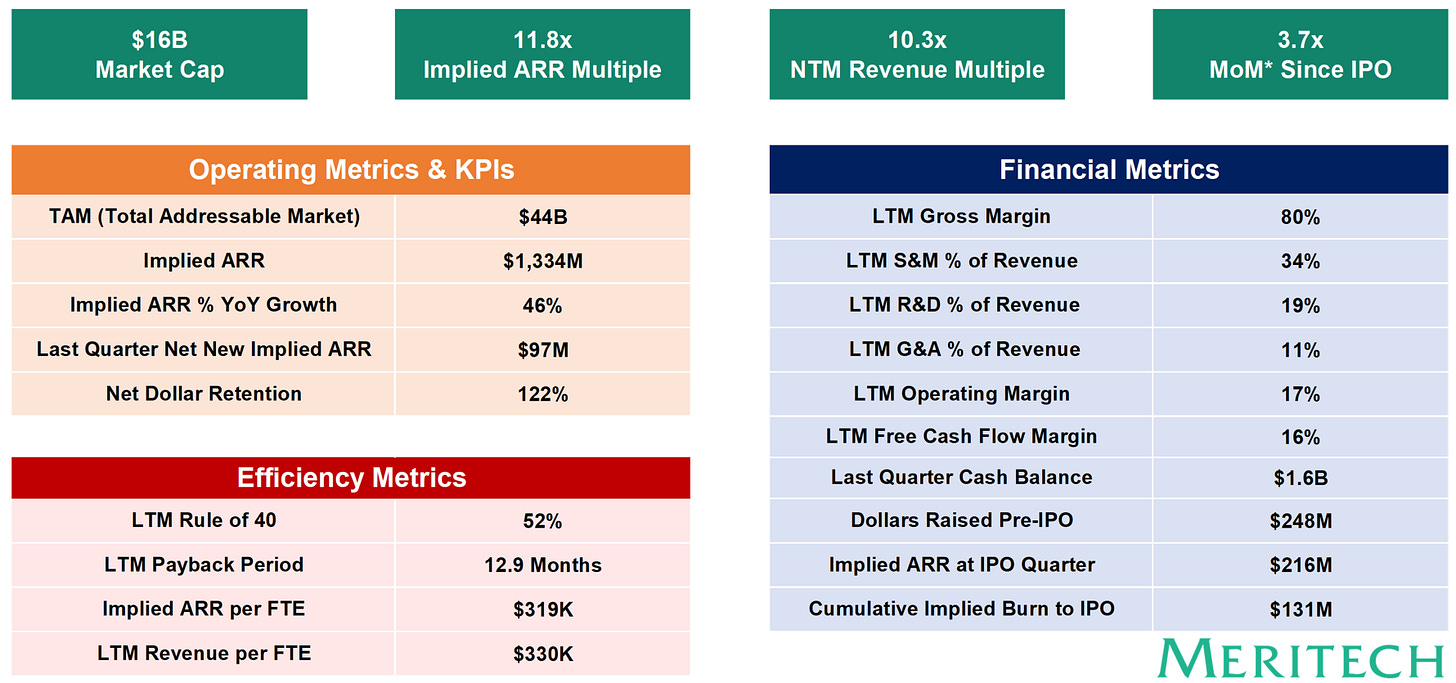

Don’t join a startup for the ride NOT for the money. Meritech Capital published a current market analysis.

📰 Here's what they wrote:

"With 70% implied ARR multiple compression, a business must grow its top-line by a multiple of 3.3x to reach the same enterprise value, which could take years. This group of company’s median growth rate is 47% and assuming that growth rate persists, it would take 3.1 years to reach that same valuation again."

💁 As an example

Imagine your startup was valued at $4bn with $100m ARR in 2021.

That's a 40x revenue multiple.

It's 2023, the market no longer uses 40x valuations. It's now 10x.

Your revenue today might be up to $200m ARR.

Based on that the 2023 startup value is only $2bn.

To become that $4bn startup again, you need $400m ARR.

To grow $200m it would take about 2 years at 40% annual growth.

So, in 2025 you're back to where you started in 2021.

That's if (big if) you manage to grow 40% year-on-year.

Note: this is very simplified and there are nuances.

🏝 Am I going retire at IPO?

If you were banking on a big IPO anytime soon. Think again.The journey might take (much) longer. The greatest startups will still be massive money-makers.

But you should not bank on it.

👨⚖️ How to judge a startup before you join?

Meritech also released a scorecard with statistics of top performing SaaS companies. You can check these against your company metrics and get an idea how you are tracking.

If your company is far from these the journey to IPO might take even longer. Currently the club of 10x ARR companies is pretty small and the entrance criteria are pretty tough. (Source: Meritech)

🧠 Lessons for Value Sellers

💰 I used to do VALUE selling. And I got it wrong. Here’s what I mean.

👨🏫 The easiest framework to manage sales reps - RPA.

⏰ How to give sales teams 10h back every week without buying a software.

🥁 How to ROCK a demo every time by Damian T.

❓ Sales Engineers don’t know all the answers and that’s ok.

🔎 The only 4 discovery questions you’ll ever need.

📱 Your buyer uses 40+ apps everyday. How do you stand out?

🏆 How CFOs stack rank technology purchases.

📌 The Best of B2B on LinkedIn & Beyond

The ultimate checklist before you join a startup by Pavillion Founder, Sam Jacobs.

PLG is everywhere, even where you least expect it e.g. QuotaPath. Check out this great post by Kyle Poyar, OpenView.

Can you make money as a VC? Yes if you get to invest in the best funds by Michael Jackson.

Generative AI is evolving fast and it’s the perfect time to jump on the bandwagon by Madrona Ventures.

Inspiring story of a B2B SaaS CEO (Spoiler: it’s Andy Byrne, Clari CEO) by Sequoia Capital

Is the UK in terminal decline - How will it impact Landon as a startup hub? via FT

Microsoft investing massively in OpenAI to dominate enterprise and consumer tech via LinkedIn

👋 Parting thought

The next time you see an amazing demo Sales Engineers delivers, remember that it’s all just smoke and mirrors. (posted here)

🙏 That’s it. Have a great Sunday!

🤓 Subscribe if you enjoyed this

If you enjoyed this, subscribe below and follow me on LinkedIn on Semir Jahic.