MV #019: It's a bloodbath and layoffs continue. Why middle managers are at risk, the vultures circling Salesforce and a silver lining.

The past two weeks revealed that nobody is immune. But there's also positive news in B2B tech that offer opportunity.

👋 Hi there, happy Sunday!

Did you have a good week?

I’ve been back in recruiting mode to backfill a role in the past few weeks. Oh boy, has the market changed.

Great talent, immediately available, reasonable salary expectations and willing to roll up their sleeves. It’s the opposite of what I’ve seen in 2021 and 2022.

Whilst I have this positive note to share, it’s the consequence of the biggest bloodbath in tech since I graduated.

Let’s dive into this week’s edition of More Value.

💰 The biggest bloodbath since 2001

“It’s a bloodbath.” - everyone in B2B tech

“It’s a bloodbath.” is probably what you’ve heard from your friends in B2B tech in the past weeks.

The news headlines were all the same across the industry. Tech is facing a brutal post-pandemic reset.

The pandemic fuelled immense growth over the last 3 years. But pandemic overhiring is only part of the story. Money was very, very cheap.

VC/PE exuberance led to massive investments in the startup sector, funding everyone with a Figma template or less. Everyone thought that 10 years worth of digital transformation happened in just a few months.

Remember, deals couldn’t be done quickly enough.

Does Tiger Global ring a bell? I think they’ll get a spot in the Guinness Book of Records for the fastest term sheets without proper due diligence. I mean who needs groceries in 10 minutes?

Fast forward to today. The headlines are fundamentally different. The pandemic hasn’t had quite the long-lasting impact everyone thought. I think some trends might be here to stay like remote work, but there’s not much else.

The big change besides the aberration of the pandemic push is a big change in monetary policy. Money is not cheap anymore.

New jargon for SaaS leaders - FED, BOE, BOJ, ECB

Yep, that’s not the usual SaaS jargon. These are the major central banks in the world trying to get a handle on inflation.

If you thought your Macadamia Latte seemed kind of expensive in 2022, wait for 2023. Inflation is still high and what the central banks need to do further increase interest rates to regain control.

Am I in a tech echo chamber?

If interest rates are high, that means rich people and institutional investors can get a pretty decent return in low-risk asset classes like bonds. Growth stocks lose their appeal.

Most tech companies were focusing on growth. Growth at all costs. In the past years, that has been the mantra.

There is a fundamental shift in monetary policy that will last for quite some time. I’m talking years. We will unlikely ever get back to what we’ve seen in the years prior to 2023. Companies now need to start addressing top-line and bottom-line figures to be successful.

The recent layoffs are a result of investors putting more value on other asset classes and companies that generate free cash flow. There’s less money around to fund startups, there’s less cheap money to fund risky projects at big and small companies.

Efficiency is the new game in town.

Below is Meritech’s analysis on multiples over the last 10 years. What’s really happening is a reversion to the mean that was normal before the pandemic.

We’re definitely not returning to the same world we had from 2020-2022. That chapter has come to a brutal end with a combination of a post-pandemic sobering up and an interest rate increase to curb inflation.

This is hitting tech much harder than other industries. And whilst you might think the world is ending based on your LinkedIn feed, it’s actually not all that bad outside tech.

The path to IPO will become a Hotel California

“You can check out any time you like. But you can never leave"

The new expectations will lead to a much longer time horizon for companies to IPO. If they ever do.

Many unicorns will turn out to be one-trick ponies that just get gobbled up by bigger firms or private equity.

In the last weeks, PE firms like Goldman have raised funds to go on a shopping spree in the coming years. And many CEOs will find themselves in a weak position to negotiate.

Beggers can’t be choosers.

If you’re new to this type of math, here’s a simple example that I posted about on LinkedIn recently. (post here)

—

💁 Quick example of why startups will take longer to live up to new valuation expectations.

Imagine your startup was valued at $4bn with $100m ARR in 2021.

That's a 40x revenue multiple.

It's 2023, the market no longer uses 40x valuations. It's now 10x.

Your revenue today might be up to $200m ARR.

Based on that the 2023 startup value is only $2bn.

To become that $4bn startup again, you need $400m ARR.

To grow $200m it would take about 2 years at 40% annual growth.

So, in 2025 you're back to where you started in 2021.

That's if (big if) you manage to grow 40% year-on-year.

Note: this is very simplified and there are nuances.

--

If you were banking on a big IPO anytime soon. 🏝🏝🏝

Think again.

The journey might take (much) longer.

The greatest startups will still be massive money-makers.

But you should not bank on it.

Middle managers in the crosshairs for layoffs

Where do you start cutting if you need to reduce your cost base by 10-20%?

In my view, middle managers are the worst position to be in. Inefficient companies have a high management overhead, and that’s an obvious place to gain efficiency.

One way companies do this is by increasing span of control.

It basically means increasing the number of direct reports for a manager. The more directs, the wider the span of control. If you have a lot of managers just managing but few people under each that’s usually a sign of inefficiency.

“In a fast-moving industry where technology is evolving rapidly, where we have to be scrappy, we can’t afford for a group of people to do nothing but be human routers of information,” Desai said of Google’s rationale. - via Bloomberg

It’s an attractive target for layoffs because you don’t lose the customer-facing reps, sales engineers or customer success managers. You also don’t lose programmers, testers and other tech teams.

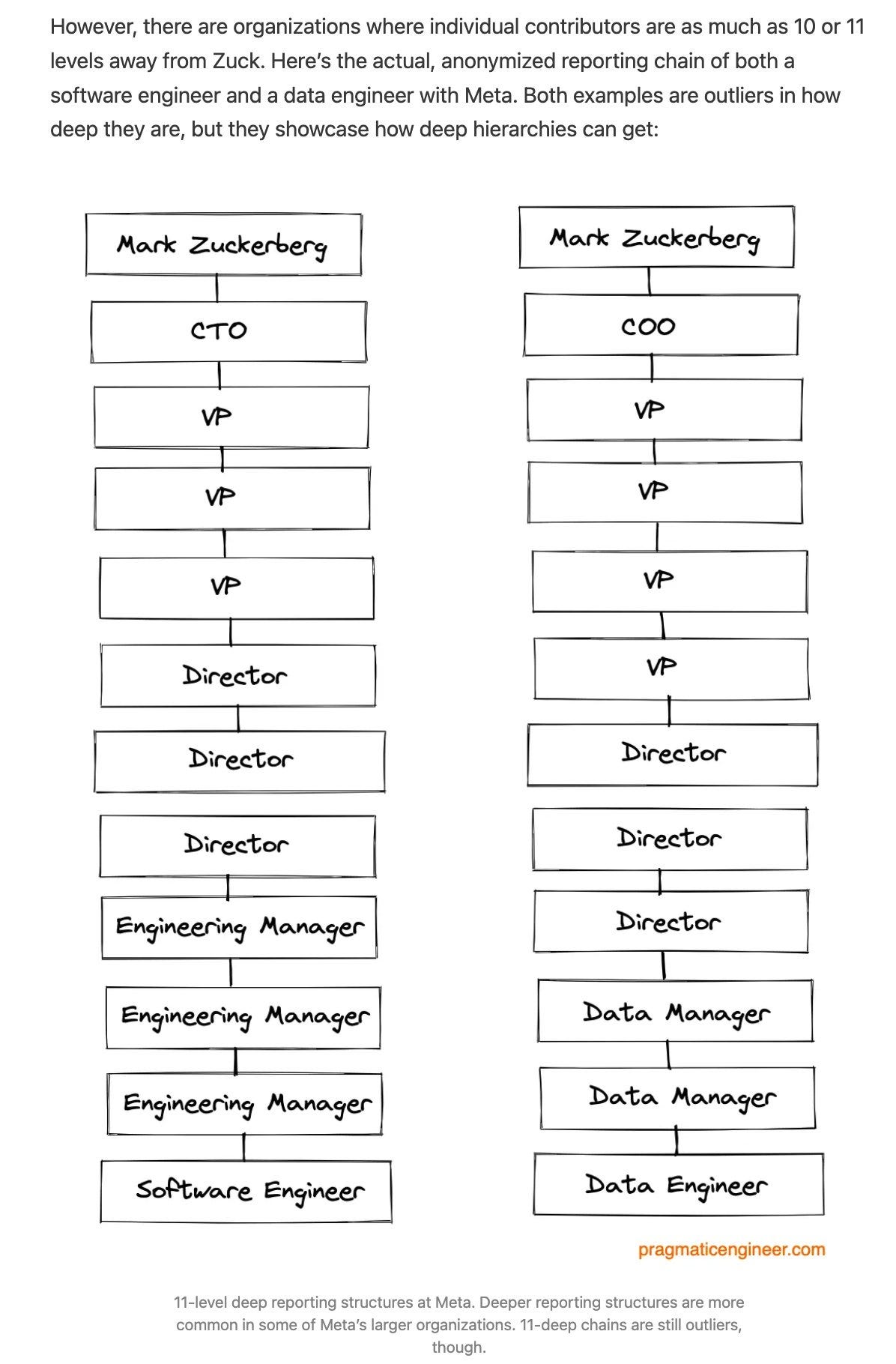

I mean look at Facebook as an example. The

has gathered data on the hierarchy structure and Mark Zuckerberg is an incredible 10 or 11 levels away from individual contributors.There’s a lot of efficiencies to be gained by increasing the span of control.

You cut the managers, and accept that there will be less 1:1 time, career opportunities and other things. But the core work will likely still get done to a decent quality.

Middle managers everywhere are under increasing pressure from both above — receiving missives from their bosses to do more with less — and below — enforcing return-to-office policies and navigating new hybrid work arrangements. A recent survey by Slack Technologies Inc.’s Future Forum found those in middle management are the most exhausted of all organizational levels. Some 43% said they’re burned out. - via Bloomberg

However, many organisations don’t see managers, only routers of information. Managers help change the business not just run the business. With that in mind, the company’s innovation speed might slow down and many things might not get done in the first place.

“The next phase is a lot of people doing two jobs at the same time. You might say that’s kind of efficient, but the cost of that is pretty big — things don’t get done well, or done at all.” - via Bloomberg

Ok, enough about theory. Let’s look at an example.

Will Salesforce lay off more people?

The short answer is yes. From what I heard in my network and doing some digging on the numbers, there’s no way around it.

I have three predictions about Salesforce.

More layoffs will be announced

Tableau and Slack will be sold (likely to private equity)

Salesforce will bounce back as a strong B2B tech player

Why more layoffs?

Some basic math using the earnings numbers shows that the per employee revenue and profit are way down at Salesforce. You might say that Adobe and Microsoft are very different companies.

But even an Oracle, which operates very similarly to Salesforce in many ways, brings in almost 2x the profit per employee.

Investors, especially activist investors, will demand more.

Revenue per employee:

SAP ➡️ $287,399

Salesforce ➡️ $360,230

Oracle ➡️ $249,647

Adobe ➡️ $602,278

Microsoft ➡️ $897,149

Profit per employee:

SAP ➡️ $15,957

Salesforce ➡️ $19,635

Oracle ➡️ $39,512

Adobe ➡️ $162,796

Microsoft ➡️ $329,131

The activist investors are circling around Salesforce

At Salesforce CRM 0.00%↑ , the vultures are circling very actively. The 5th activist investor Loeb's Third Point has taken a stake in the company.

Third Point joins Elliott Investment Management, Starboard Value, ValueAct Capital Partners and Inclusive Capital to build pressure against the Salesforce leadership to make more changes.

The Wall Street Journal reported this story first and quoted Marc Benioff, Salesforce CEO

“As our revenue accelerated through the pandemic, we hired too many people leading into this economic downturn we’re now facing,” Salesforce Chief Executive Marc Benioff wrote in a letter to employees announcing the layoffs.”

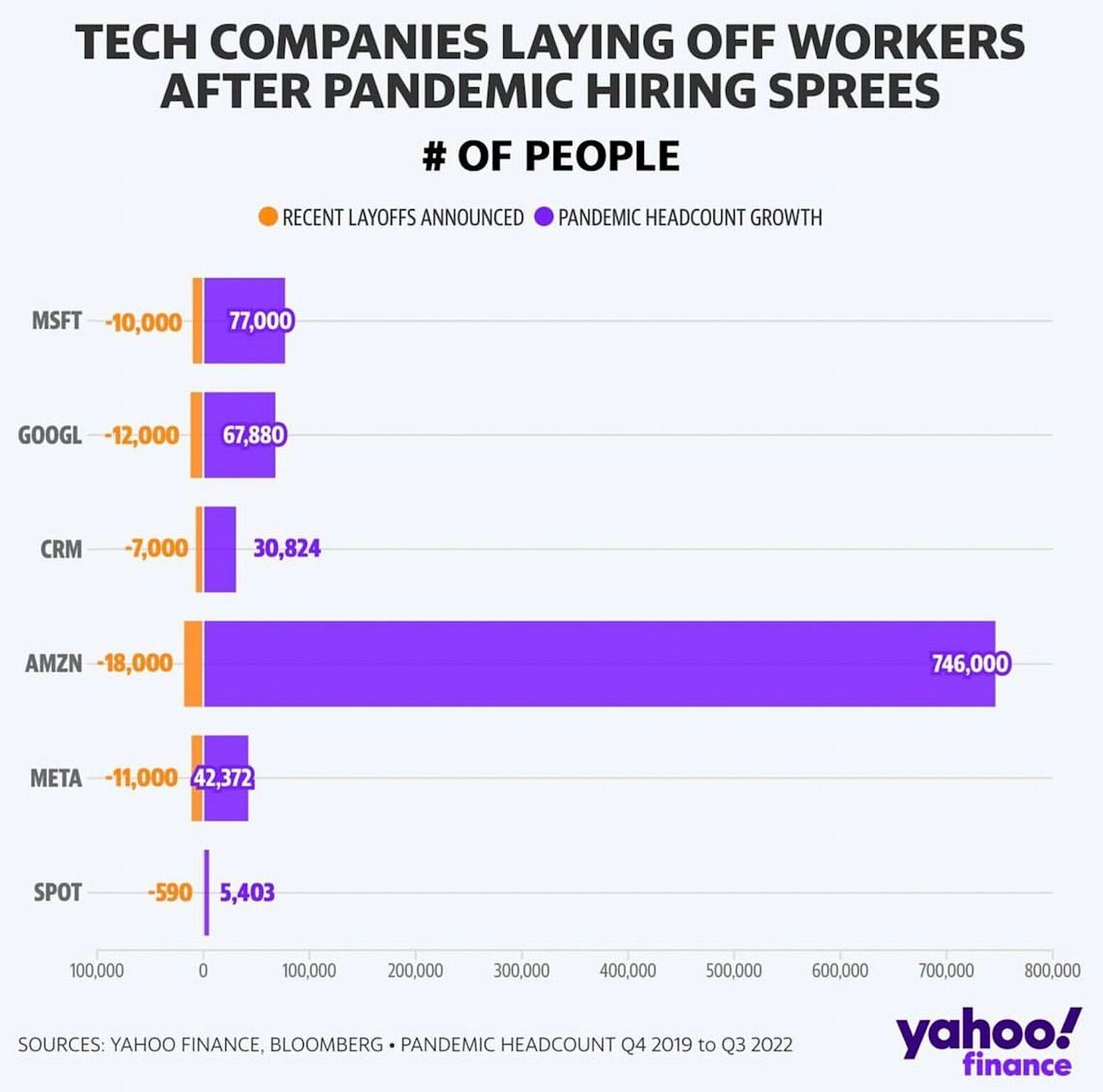

Salesforce has announced layoffs a few weeks ago and is planning on letting go about 10% of its workforce. That’s roughly 7500 people. When Marc Benioff references the over-hiring during the pandemic, it begs the question, was it enough?

The hiring spree since 2020 led to an extra 23,542 employees hired at the company. Some came from acquisitions like Slack. But Slack only had about 2000 employees at that point.

Salesforce already had a pretty bloated organisation with lots of inefficiencies pre-pandemic, which only adds to warranted asks to get lean and optimise margins.

The activist investors are circling like vultures. I think, besides gaining operational efficiencies, more cuts will need to be made.

Divestitures - Slack, Tableau and shutdown of risky bets

There’s less science to this prediction. Watching my LinkedIn feed I noticed two types of people losing jobs.

Acquisitions (Slack and Tableau)

Unprofitable / nice-to-haves (Net Zero Cloud, …)

I haven’t noticed many of the core Salesforce team members post on LinkedIn about layoffs. This tells me that the company is trying to improve key metrics like efficiency for a sale.

Others that I’ve seen lose jobs are on side projects funded throughout the pandemic boon. Net Zero Cloud, NFT Commerce Cloud and all that hype stuff is probably going to get shut down. In my opinion.

Bounce Back

Having said all that.

I’m an eternal optimist, and Salesforce has an extremely strong core product, great culture and a cult-like following.

It might not be that sexy 20%+ CAGR SaaS anymore, but it will certainly remain strong once the company has weathered the storm.

Salesforce also has always had pretty strong financials, generates a lot of free cash flow and has an incredibly sticky platform.

And as the saying goes: culture eats strategy for breakfast.

The entire ecosystem that Salesforce built, the learning platform Trailhead, the open technology for anyone to integrate with, and the people who built impressive careers in the ecosystem are here to stay. In that sense, I’m rooting for Salesforce in the long run.

Silver lining?

If you’re in tech, you have to brace for tougher times ahead. But on the positive side, the rest of the economy isn’t so bleak. Yet. Bloomberg said the recent US jobs report this week shows that job growth is strong.

The massive job losses have been contained to tech, and on a net-net basis over the last few years, tech has created many jobs.

Of course, many people losing their livelihoods is sad in many ways, and how it’s handled at some companies is shocking. But overall, most of these companies have grown immensely and created many well-paid jobs.

On a side note, startups and non-tech firm have a huge opportunity to gobble up amazing talent to help them build the next big thing or help transform a company.

More optimism in early-stage startup land

While it’s been a bloodbath in tech recently. It’s not the same for everyone. It’s actually the opposite.

I talked to three seed stage SaaS founders this week. It seems like there’s never been a better time to start building a business that will change the world.

They’re excited, they’re getting funded and they’re solving real problems. In this new environment only startups that have solid plans, a solve a pain and create real value will win.

You can’t be a nice-to-have one-trick pony. Let alone a one-trick unicorn.

There’s a great opportunity to make an idea real, get amazing talent and create new enduring companies and many great jobs if you’re just starting out.

🧠 LinkedIn Wisdom for B2B Tech Professionals

💸 Get your equity right. It could change your life. - via

💘 Sales Engineering can be more efficient. Think about self-service demos.

👔 How to get promoted to startup C-suite via Sam Jacobs, CEO at Pavillion.

🌍 Lessons on competition in markets abroad. When they leave, go for the land grab.

📉 Spend is down across all categories. - via Brex.

🍓 Former Salesforce CEO is back in startup land. - via Bret Taylor.

🧰 How Retool delivered value early and got a $3.2bn valuation via

🤪 8 stakeholders sales team will meet in a demo.

🪠 Pipeline trends CROs need to track for boards via Zorian Rotenberg

📊 Excellent perspective on COGS vs. Opex via The SaaS CFO

📌 B2B Tech Roundup

OpenAI alumni are creating amazing AI companies after leaving via Amit R. Naik

Startup valuations keep falling. No bottom in sight. via CB Insights

Superb 20min VC episode with Orlando Bravo and Harry Stebbings via LinkedIn

The biggest demo fail in history cost Google $100bn in market cap via CNN & Forbes.

👋 Parting thought

I’m a big believer in everyone at a software company being part of the sales team.

As a presales leader, I hire commercially-minded SEs who want to win deals. Not just be product experts.

This post summarises my thoughts well.

🙏 That’s it. Have a great Sunday!

🤓 Subscribe if you enjoyed this

Enjoyed reading this? Subscribe and share this edition with your friends.

Thank you so much. I’m Semir Jahic, and I hope to see you again for the next edition in two weeks.