MV #021: Why Salesforce $CRM is up 30%, SVB collapses & why I thought of Adele

The downturn continues and ripple-effects cause massive disruptions.

This bi-weekly newsletter is made for leaders to get smarter on startups, growth & sales. Want to get top industry news, useful learnings, and interesting observations to your inbox, subscribe here:

☀️ 1 news story for B2B leaders - Salesforce earnings

Salesforce CRM 0.00%↑ announced fantastic earnings, and I went on to analyse the transcript to see what it might mean for tech leaders. The stock jumped 14% and sits at a 30% gain since the start of 2023.

Salesforce is one of the largest enterprise software companies. Since its launch 1999, it grew and almost hit $30bn in ARR.

Thousands of startups are built around or rely on Salesforce. We all look at the behemoth and try to understand what it means for us.

The company has come under a lot of pressure recently by a number of activist investors.

The software group is an activist’s dream: a very large company with an outstanding core business that is goofing around on the periphery and has a weak valuation as a result. It’s been this way for a long time - via the FT (article here).

But Marc Benioff has been around the block a few times from launching Salesforce in 1999 and charging ahead to grow the company into a $30bn ARR powerhouse.

So, this must have been the reaction in his mind.

And indeed, Marc Benioff pulled off a great quarter. Salesforce crushed its FY23 earnings.

Salesforce beat expectations across the board.

Revenue beat: $8.38 billion, vs $7.99bn analyst est.

Earnings per share beat: $1.68 per share vs $1.36 per share.

Doubling of share buyback program to $20bn.

Improved Q1 forecast to ~$8.18bn vs analyst est of $8.06bn.

But in 2023, things are changing for all of us.

From Marc Benioff, CEO:

“Improving profitability is our highest priority”

Here's what he means by that:

Reigniting performance culture

Scrutinising every dollar of spend

Prioritsing core product innovations

Transforming go-to-market motions

👉 My take: we've seen a lot of this. As sellers, we observed it and as employees, we experienced it. If leaders are not looking at 1, 2, 3, and 4 at your current company, I hope they will!

From Brian Millham, COO, goes into detail on the how:

- Reduced the size of the sales and success org

- Removing layers and increasing spans of control

- Ensure fast onboarding [..] and speak customer's language

- Increase ASP by solving more problems w/ a single selling motion

Salesforce's mantra for years was: More AEs = More ACV. But that's changing as the COO points out:

"We've always kept productivity flat and hired more AEs to drive our growth. We're going to inverse that equation going forward and think about productivity as our driver."

👉 My take: This is a fundamental change. I remember Marc Benioff presenting More AE = More ACV at an all hands, and that's no longer the approach. Productivity is the new game it town.

📚 Everyone should review their playbooks and go-to-market.

What can you do now?

Ask: What is needed so all GTM speak the customer's language?

Ask: How can I enable my sellers to sell our entire product suite?

Ask: What playbooks can I build to drive consolidation plays?

Ask: How can I create accountability to drive performance?

Ask: What do highly productive reps do that others don't?

Ask: How can I coach my team to execute flawlessly?

Ask: How are we partnering cross-functionally?

From the COO at the end of the call:

"We're training our people to navigate those headwinds that we've got in the market to go execute better."

👉 My take: A lot of the success in 2023 will come from great execution in this new, challenging macro environment. Every team has to step up, lean in, and help the GTM teams to drive success.

🧠 1 thing I learnt on Twitter - SVB collapse

The only thread you need to understand the Silicon Valley Bank (SVB) collapse.

👉 My take: It’s a massive shame to see this excellent institution fall prey to an incredibly fast bank run. I know it’s in the name, but the digital world has accelerated the pace of bank runs. Everything unfolded within 48h.

Even the UK-based arm of SVB is under pressure because of the irrational behaviour that is spreading. I wrote about it here.

“Silicon Valley Bank UK said earlier on Friday that it was a standalone entity with an independent board of directors, ring-fenced from the parent company and other subsidiaries.”

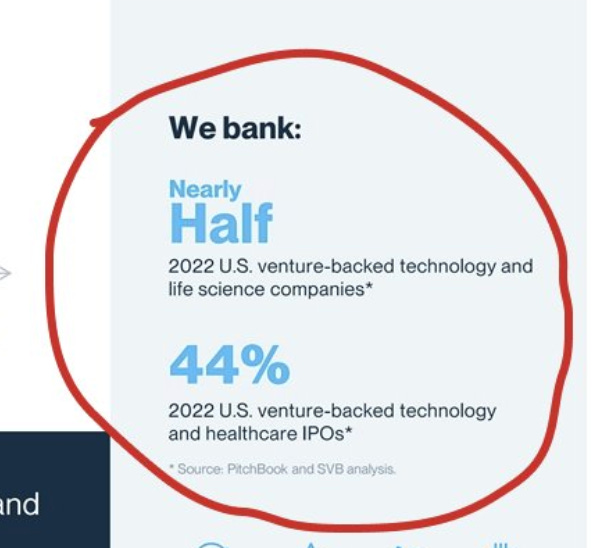

This could have catastrophic ripple-effects on the startup ecosystem since SVB is so deeply embedded in the tech world. They bank with half of US VC-backed technology and life science companies.

I really hope governments, bankers and investors will come together to support this iconic institution that has helped the startup ecosystem for decades.

📌 2 things you might have missed in B2B tech

🚀 Growth at all costs is over, but turning a profit remains incredibly hard (full post)

📉 On post IPO track record

"Of the 91 recently listed tech groups that have reported results so far this year, just 17 reported a net profit. [...] About half of the 91 were lossmaking at an operating level — meaning they could not simply cut back on investments if they needed to conserve funds."

🔍 On finding product market fit post IPO

“What the public are now seeing is something that was [previously] digested in the VC space . . . [companies] are proving out on the public stage whether or not they have a viable product or market for their product, and there will be mixed outcomes. Some of them may cease to exist or get ‘acqui-hired’."

And that also shows in valuations.

📉 Late-stage startup valuations are down 50%+ (full post)

That's tough, and only some will prevail.

🚀 Two types of companies are more likely to succeed:

🔴 The Well-Run Must-Have Business

"Startups selling “must-have” products like cyber-security or budgeting software should do well. Money will also keep flowing to well-run businesses with strong balance sheets"

🔴 The Next-Big-Thing Business

"Firms with buzzy new technologies, such as artificial-intelligence chatbots and other whizzy “generative ai”, will keep attracting capital—especially if the tech works in practice and underpins a viable business model."

👉 My take: I absolutely agree. Are you a painkiller, vitamin, or candy?

1/ Painkillers, it hurts!

You have to be an absolute must-have tool to win. Painkillers are winners, but some buyers can live with pain and won't take treatment even if you offer it. It's going to be hard either way. Prove value, execute well and keep tension on the line.

2/ Vitamins, who knows?!

Nice-to-haves without deep evidence of benefit will have the hardest time. If you're a late-stage vitamin, I don't know your way out. 🤷♂️

3/ Candy! There are always people looking for that sugar high.

Candy is exciting. But you need a long-term strategy to survive beyond the initial sugar high. For instance, AI is en vogue, but if you don't deliver value, you'll be churned out faster than you can say Kit-Kat.

👋 Parting thought

I’m off to Las Vegas for our in-person company kick-off.

It’s going to be weird.

Since our last in-person kick-off three years ago the company grew from about 250 to 750 people I’m so used to working remotely, always having my Slack and LinkedIn ready, that I have almost completely lost my ability to remember people’s names, positions and faces.

I can already sense there will be quite a few embarrasing interactions.

“Hi, I’m Semir, nice to meet you.”

“Semir, it’s me, we’ve been on Slack like a 100x times.”

😬

Send me good wishes to recognise and remember as many people as possible. I’m sure it’ll be amazing to see many again after all those years working together remotely.

🙏 That’s it. Have a great Sunday!

🤓 Subscribe if you enjoyed this

Enjoyed reading this? Subscribe and share this edition with your friends.

Thank you so much. I’m Semir Jahic, and I hope to see you again for the next edition in two weeks.