MV #024: Will uncertainty still dominate after earnings?

Salesforce is up. Is SaaS back? Meanwhile, AI is on fire. And everyone is waiting on earnings season to see what's going on in big tech.

This bi-weekly newsletter curates news for SaaS leaders to get smarter on startups, tech trends & sales tips. One email. Packed with tips, learnings, and observations from around the web. Made with love ❤️ Subscribe here:

“Lots of guys watch Bruce Lee movies. Doesn’t mean you can do karate.”

This quote from Billions reminded me that there are a lot of so-called experts out there with advice. Advice from old books, academia, and theoretical frameworks. Few have actually managed to navigate a downturn, high-interest rates, and inflation effectively. Always question them and make up your own mind.

🧠 1 Learning

🔗 Link: Jamin Ball from

is excited about earnings season. We’ll see how Q1 was and what guidance for Q2 looks like. If there is consensus that tech is accelerating again Q2 that would be great. If there’s still doubt, then 2023 might remain uncertain. Looking at the trend from the big cloud providers, the picture is bleak. The question is: are we past the bottom?

👉 My take: I agree with this take. Many companies, including startups, have replanned their year.

The operating plans have more conservative targets. Q1 might look bleak in many software companies, but that will be accepted. It can be attributed to the usual start-of-year slowness due to new teams settling in, learning about their territories, spending time at kickoff etc.

But for Q2, there’s no excuse. The new plan has to work. If not, then the entire annual projection might be off. If that’s the case, companies must take action and further adjust - read layoffs, restructure and more.

Regarding big tech, you can see below the major cloud providers AWS, Azure and Google are on a downward trend. Is this going to reverse or slow down? We’ll find out soon.

Here’s the earnings calendar for next week. Keep your eyes peeled for an exciting week, hopefully giving investors and everyone else in SaaS a better picture of the wider market. Microsoft MSFT 0.00%↑ , Amazon AMZN 0.00%↑ and GOOG 0.00%↑ are particularly interesting to watch.

📺 1 Video - The Best Demo of the Week.

🔗 Link: The Inside Story of ChatGPT by Greg Brockman

🤖 AI News for SaaS Leaders

🔗 Link: The fascinating story behind how 11 people built the AI image generation app that’s taking on the world - Midjourney by

🔗 Link: From Sequoia: Generative AI Is Exploding. These Are The Most Important Trends To Know.

🔗 Link: InsightPartners shares how they invest in generative AI companies.

💎 3 Things I Read

🔗 Link: BCG released a report on SaaS. I didn’t buy it. Here’s why.

1. 46/109 of surveyed companies are at pre-seed or seed stage.

2. 55% of surveyed companies have less than 100 employees.

3. 69% of surveyed companies are less than 5 years old.

👉 My take: this does only represent a small fraction of B2B SaaS. It's a great hook to get people to read the report but wider B2B SaaS is in a world of pain.

🤔 What's top of mind in SaaS in my view?

1. Valuation compressions - how do you grow into your last valuation?

2. Buyer scrutiny - how do you sell effectively and efficiently?

3. Fear or messing up - how do you overcome buyer risk aversion?

4. Talent - how do you keep teams motivated in a downturn?

5. Retention - how do you drive value realisation to win the renewal?🔗 Link: Crunchbase reported that funding in Europe is still going through pain.

🔗 Link: Bessemer Ventures Releases their State of the Cloud 2023 report.

💡 5 Insights for SaaS Leaders

🔗 Link: Salesforce CRM 0.00%↑ is up 47% year-to-date, and the stock shows signs that the company turnaround is working and investors are buying into the story.

👉 My take: Salesforce has been going through a lot of change. Some of the activist investors are standing down (here). The company also has let go of many of its superfluous overlay sales teams, starting to create more efficiency in the go-to-market motion. Those actions have been taken on positively. The question is, will this all lead to better results in Q1 or is the impact on morale a factor that could harm sales? We’ll find out during the earnings season.

🔗 Link: Stage 2 Capital is looking for great B2B SaaS companies to fund. Apply now and join some of the most ambitious companies in the industry.

🔗 Link: Some great podcasts share on Twitter by CBI Insights founder Anand Sanwal. Worth looking at the list and comments.

🔗 Link: On Demos….Buyers want to see the product. “Just Effing Demo” by Dave Kellog brings this point to life beautifully. I wrote about the same topic this week 🔗 here.

🔗 Link: Can AI replace a well-paying job like the one of Salespeople? How about Sales Engineers? In 2023 the answer is: probably, but only partly.

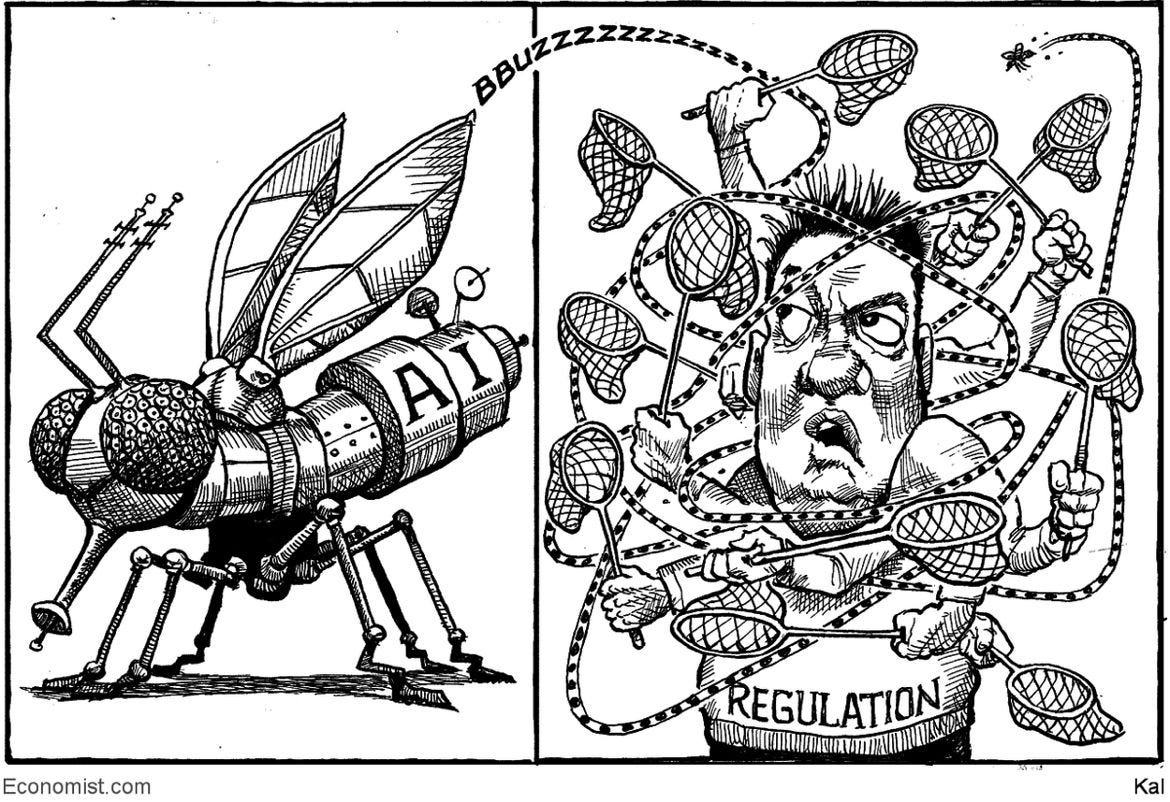

🤯 Cartoon of the Week - AI vs Regulation

👋 Parting thoughts

Immensievly enjoyed reading through 100 mistakes building a SaaS company by Anand Sanwal, CEO and Co-Founder of CB Insights.

This is packed with valuable learnings. Absolutely worth your time. 🔗 Link

🙏 That’s it. Have a great Sunday!

🤓 Subscribe if you enjoyed this

Enjoyed reading this? Subscribe and share this edition with your friends.

Thank you so much. I’m Semir Jahic, and I hope to see you again for the next edition in two weeks.