MV #026: Shrinking ARR, Sales Lessons from the Movie AIR & Why Time Savings Don't Matter

Public companies wrapped Q1 and some shrank in total ARR. Meanwhile sales professionals can learn a ton from feel-good movie AIR.

More Value is for curious minds who enjoy curated news, learnings and insights on startup building, SaaS trends & sales. No fluff. All value. One email.

Hello and happy Sunday

I’m so happy you’re reading this. Fourteen days can feel like an eternity in SaaS, especially if you’re in Sales at a startup. So many moving parts, you barely get time to read relevant news, get a pulse on the industry and learn a few things.

That’s where I come in.

Today’s edition has gems from LinkedIn, Twitter and the internet for SaaS leaders like you to get you up to speed on everything you might have missed!

Enjoy!

💰 Sales

🔗 Link: “Up to 96% of customer lifetime value comes AFTER the initial sale”, says Pablo Dominguez.

👉 My take: If 96% of value comes after the initial sale, then I’m shocked so many organisations have broken processes to hand off deals to implementation and success teams. This stat should remind you that it's more than just the value you sell but the value you realise for your customers that determines long-term success.

🔗 Link: Kyle Poyar’s Growth Unhingedwrote a piece on software benefits and asked

about SaaS salespeople trying to sell time savings. OnlyCFO’s response is clear:“Sorry, but time savings doesn’t make your software special.”

👉 My take: Time savings is truly only one benefit and more a by-product. Going deeper to show real value means you've understood the buyer's business, which can help you differentiate.

A problem that results from that is also bad implementations following bad evaluations. As you mention in the urgency section, many have been burnt in the past and fear that they will mess up again with another tool. Better stick to the status quo if it's just about time-savings.

But if you break it down, ask why and go deeper, you can uncover impactful value drivers.

🔗 Link: Crunchbase posted a great article by Calendly CRO Kate Ahlering. Economic uncertainty is challenging sales teams, slowing B2B sales cycles and requiring rapid adaptation to new selling strategies.

(1) AI and automation are crucial tools for streamlining the sales process, (2) improving efficiency in lead routing and scheduling, and (3) enhancing personalised communication.

According to the article: 82% of sales professionals have had to adapt quickly to new ways of selling.

These technologies allow sales and marketing teams to work more cohesively, driving revenue and improving customer experience.

👉 My take: No doubt, sales professionals haven’t even seen 1% of the change that they need to anticipate by AI in their work.

🚀 Startups

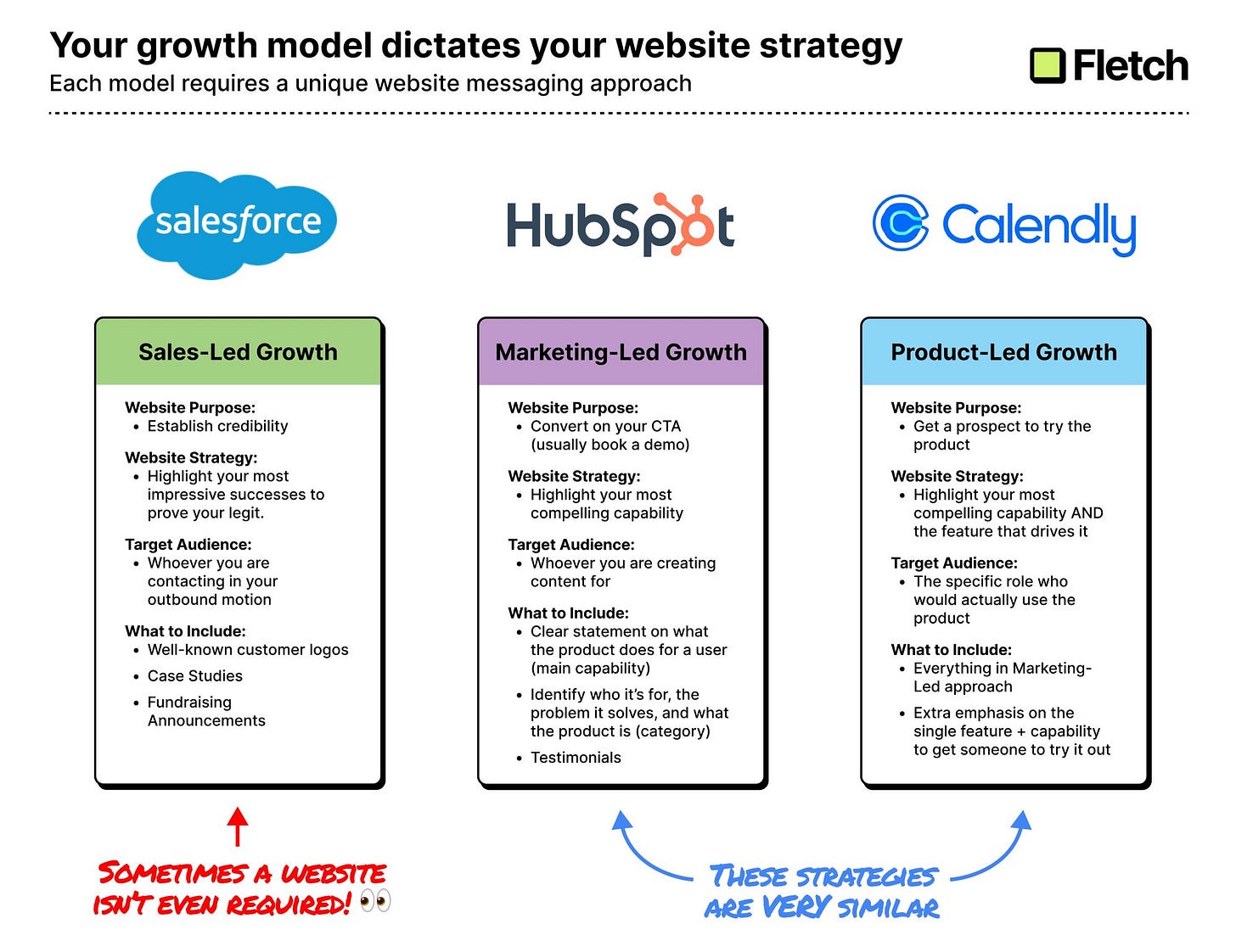

🔗 Link: Ever thought about how GTM strategy should define your website strategy? Check out the great breakdown by Robert Kaminski.

👉 My take: Whether sales-led, marketing-led or product-led, you must adjust your website strategy.

I agree with Robert’s breakdown. Too often, websites come across as either Wiki’s of a product, as Robert puts it, or they are manifestations of marketing and design about a brand, category or vision. Looking at your website as a critical GTM asset is the way to go. Everything else is fluff, noisy and mostly useless.

🔗 Link:

breaks down the choice between bootstrapping and venture startup.👉 My take: In the post, it seems mostly black and white. Build a lifestyle business which sounds like a little side gig or a billion-dollar company using VC funding.

There are a lot of nuances in between. Remember that most businesses worldwide are not venture-backed; they do great, employ hundreds or thousands of people, and do so sustainably.

The post is great, however, in breaking down how VCs and founders should evaluate their business idea from different angles like TAM, the path to IPO, growth estimates, and business models.

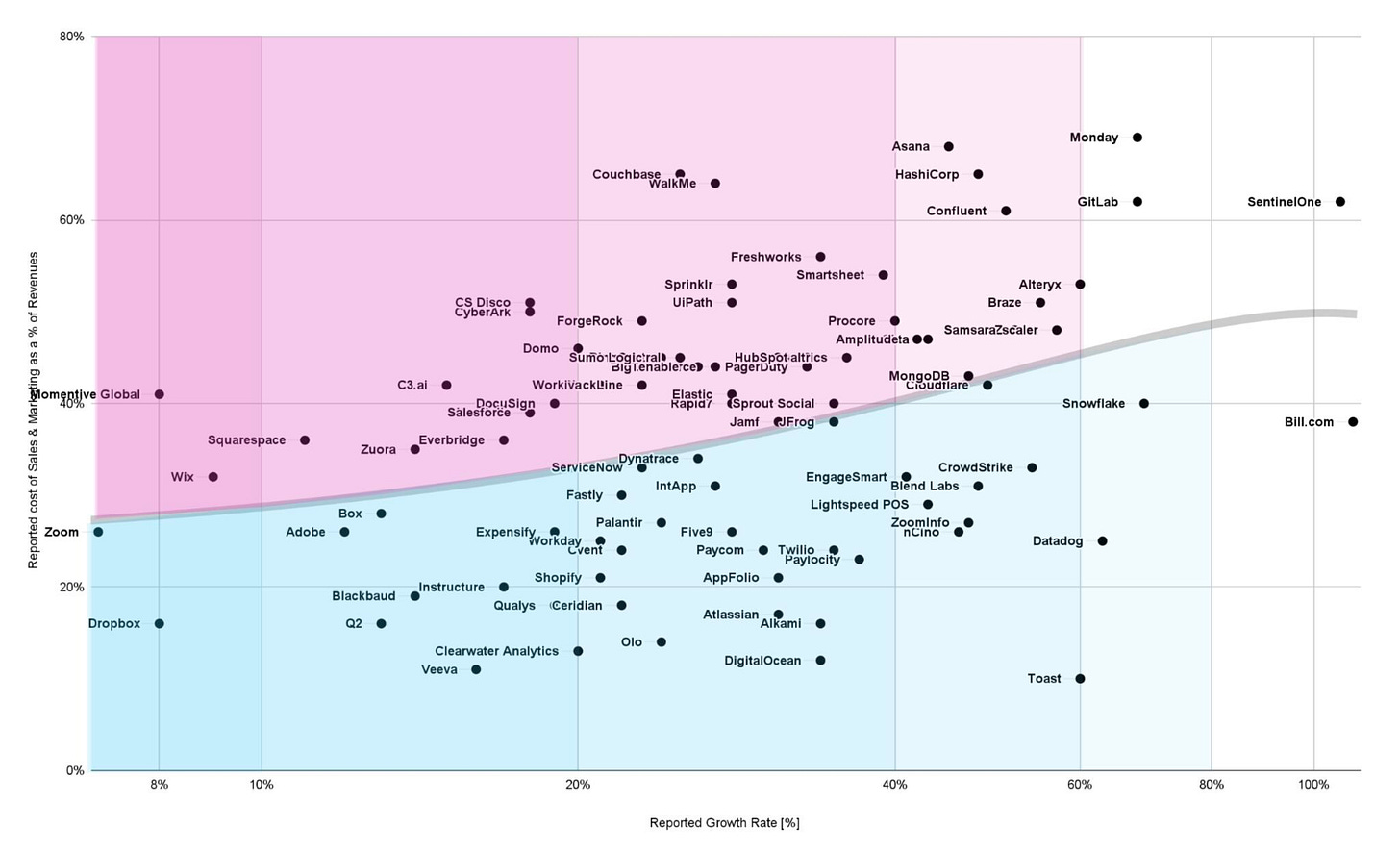

🔗 Link: Growth at all costs is over, but what that means differs for every company.

👉 My take: Great chart by Winning by Design. It would be great to track the dots over several quarters and do a before vs after.

I imagine many of these dots have moved in some direction over the last few quarters. And many are still transitioning from high spending to low spending in sales and marketing.

I wonder what the CEOs of each company would say about where on the journey they are and where they aim to get to by the end of their fiscal year.

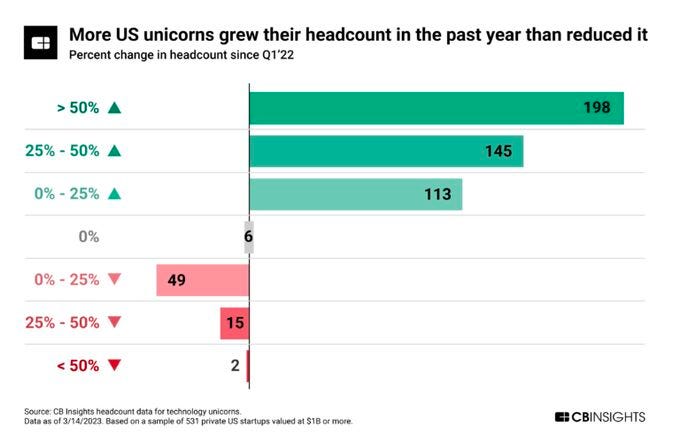

🔗 Link: Going against the layoff narrative. Unicorns are still hiring, as per CB Insights.

👉 My take: This either tells us that mass media is wrong or unicorn CEOs are delusional. Which is it?

🔗 Link:

, Partner at Openview, surveyed 1’000+ SaaS companies on their pricing and shares key learnings for each stage Seed, Expansion, and Growth.👉 My take: In summary: at Seed stage, everything is in flux. At Expansion, build ROI and value case to capture more revenue. At Growth, pricing and packaging get more nuanced and complex.

🔗 Link: Dirk Sahlmer posted his notes from the massive SaaS conference OMR in Germany.

👉 My take: There are fewer deals. But the deals that do get done seem great. It's just that much fewer get done - unless you do something with AI. 😜

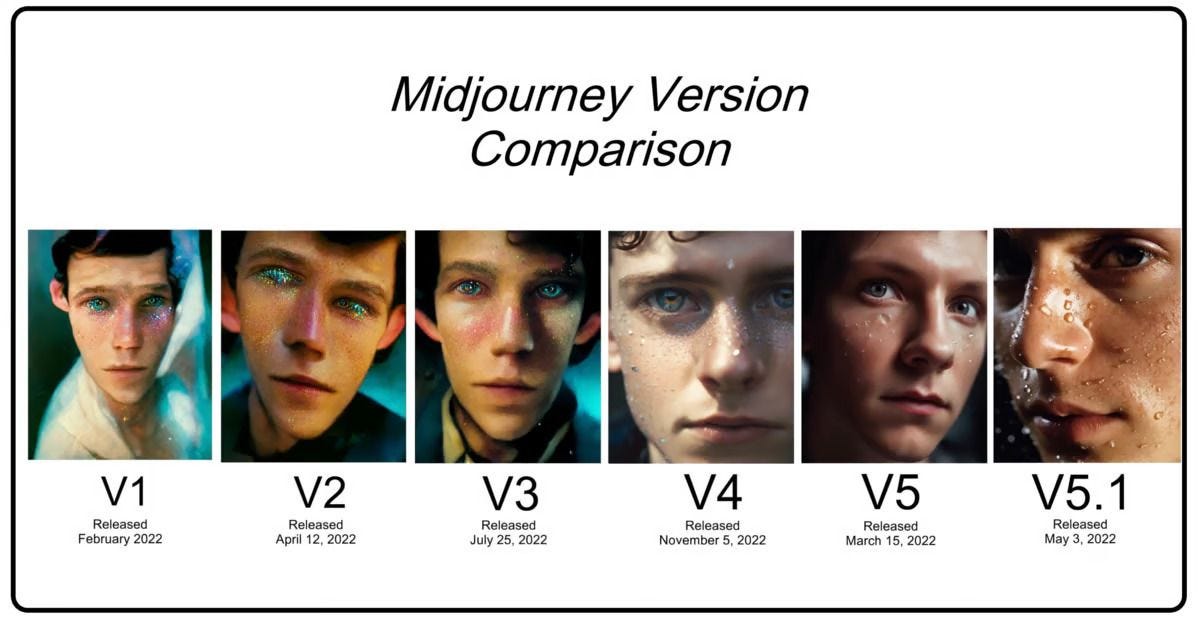

🔗 Link: Remarkable progress in AI. Worth thinking about how other use cases impact your role, company and industry.

👉 My take: I'm dumbfounded by comments online from people saying, "The hands look weird. This will never replace Hollywood." or "This is not a Spielberg-quality script.” That misses the point.

It's not about replacing the top 1% of content today. But at this trajectory, it will blow out of the water the bottom 50%+ of creations within a few quarters. If you don't embrace it, it won't take long until even the top 1% of creators find it hard to create something distinctly different or better than AI can.

☁️ B2B Software + SaaS + more

🔗 Link:

posted his latest analysis on cloud companies and the picture is not rosy.👉 My take: Despite the positive stock performance of tech, the reality is sobering. According to Jamin: 5 companies even saw their overall ARR shrink from Q4 ‘22 to Q1 ‘23. These are Zoominfo, Fastly, BlackLine, Dropbox, Twilio.

Let me write that again: 5 publicly listed companies contracted total ARR. All those reps selling at Zoominfo and co. have lost more business than they’ve won.

Even if the analysis is not 100% accurate because ARR has to be derived from publicly available data, it’s a sobering picture of what is happening in the market despite the NASDAQ rally.

🔗 Link: Making sense of generative AI in B2B software. Excellent CIO conference insights by Sapphire Ventures.

👉 My take: In summary, this is what CIOs shared:

We're all testing generative AI use cases in production to innovate fast.

Software budgets are mostly flat making sales easier for incumbents like Microsoft rather than startups.

Companies are rapidly introducing guidelines on the use of LLMs and GPTs.

Generative AI has yet to prove value in many use cases.

Differentiating hype and real AI use cases is tricky with all the noise.

🔗 Link: Louis Coppey, from Point Nine shares his US travel expedition notes where he learnt a ton about LLM, AI and ML trends and how it impacts SaaS.

👉 My take: The blog post goes heavily into technical detail but SaaS leaders should know this.

SaaS companies should experiment quickly and try generate extra revenue streams through generative AI features. Many are doing this already, including Notion, Salesforce and Microsoft.

Retention will be a massive issue post initial excitement, especially for fast commoditised product features like auto summary of text or video.

🔗 Link: NFX, a VC, posted The AI Startup Litmus Test. These are great questions to ask about your company if you’re doing something with AI.

👉 My take: Like with any major technology shift, many ideas and companies will emerge but not all of them have a reason to exist, let alone will become enduring businesses.

🔗 Link: David Rosenthal, a Swiss lawyer, shared a wonderful framework for AI and data protection.

👉 My take: This is the first I’ve seen that succinctly highlights areas for regulators to address as generative AI finds its way into enterprise software. As exciting as it is to work on use cases, it’s just as important to think about how to govern such technology effectively.

🔗 Link: Anand, CEO at CBInsights, shares the latest on funding an AI.

👉 My take: Interesting to see M&A activity going up.

Over the next two quarters, M&A will see further acceleration as companies get into crunchtime after raising money in 2020/2021 with extremely high valuations.

Failure to raise will lead to startup death, down rounds and lots of activity in M&A.

👋 Parting thought - The turnaround of Nike with Jordan

Looking for something fun to watch?

Watch Air.

This feel-good movie with Ben Affleck, Matt Damon and Viola Davis has many lessons for sales professionals.

Nobody wins alone.

Never ever, ever give up.

Don’t take no for an answer.

Break the rules of convention.

Truly understand your customer.

Remember what made you successful.

Pivot with confidence when you need it.

Know your competition - inside and out.

Ask for forgiveness rather than permission.

Prepare every part of your pitch to win a deal.

🙏 That’s it. Have a great Sunday!

🤓 Subscribe if you enjoyed this

Enjoyed reading this? Subscribe and share this edition with your friends.

Thank you so much. I’m Semir Jahic, and I hope to see you again for the next edition in two weeks.