MV #027: What Marc Benioff & Sam Altman Discussed over Dinner and Salesforce Earnings

Lessons from Salesforce Q1 Earnings, AI and Getting Ready for Tough Times in Startups

👋 I'm Semir, and I write More Value to share opinions, observations, learnings & tips on my three favourite topics. (1) startup building, (2) SaaS (B2B software) and (3) Go-To-Market (especially Sales). No fluff. All value. Every other Sunday.

Hi there

This week, I dissect Salesforce CRM 0.00%↑ Q1 earnings. With Q1 earnings in full swing, there’s plenty to learn from the SaaS juggernaut. I reviewed the entire transcript. There are some interesting insights for all SaaS professionals.

As the earnings season continues, things will get even harder before they get easier. Jason Lemkin, SaaStr, posted as much on LinkedIn this week 🔗 Link.

Let’s dig into Salesforce now!

⛅️ What SaaS leaders can learn from Salesforce earnings

"Customers continue to scrutinize every deal." - Marc Benioff, CEO.

According to Salesforce executives, AI is the biggest and most important topic to help the share price go up and instil confidence in investors. They can’t stop talking about AIs, LLMs, and GPTs.

AI was mentioned: 53 times

GPT was mentioned: 32 times

LLM was mentioned: 26 times

But first things first. Last night, Salesforce CRM 0.00%↑ announced Q1 earnings. I reviewed the complete transcript of the earnings call, and here are my top takeaways.

SaaS professionals should read closely.

1. Growth in 2023 - It's all relative

Salesforce grew 11% in quarterly revenue, its slowest pace in 13 years. That’s not necessarily a bad thing. It's all relative in this economic climate. Most companies including highly successful ones like Salesforce, have to redefine growth for 2023.

SaaS leaders should reading this should know: You're not alone. Startups face big churn and are contracting total ARR in many cases. This is especially true for late-stage growth startups that are waking up to their products being nice-to-haves in an era of free money.

That’s the type of software that gets cut first. A founder I talked to told me he contracted $2-4m ARR over the last few quarters. If you're growing, you're doing well. 50%+ growth is extremely rare.

Salesforce might not have shown growth rates like in the past, but the company is still doing pretty well.

2. Competition - Stay paranoid

"The company faces stiff competition from deep-pocketed legacy vendors such as Oracle in a crowded cloud-computing market." -Amy Weaver, CFO

Competition is tough at all levels. If you’re a pre-revenue startup, you will compete against VC-funded startups. VC-funded startups compete against peers and goliaths. Even the goliaths like Salesforce must fight off SAP, Oracle, Microsoft and other giants to win.

The way GTM teams can win is to focus on competitive intelligence, field enablement and ensure the teams always stay paranoid.

It’s not by chance that MEDDPICC has a whole letter dedicated to just this topic. Leaders must drive urgency and ensure every sales cycle, new logo and renewal, runs flawlessly.

Stay paranoid. Always.

3. Macro & Diversification

"Macroeconomic pressures in the US and demand from financial services and technology companies slowed in the quarter." - Amy Weaver, CFO

Startups start with one product. Don’t stretch yourself too thin as the saying goes. Find strong product-market fit and scale. That’s the right way to start at the beginning.

But as you scale, it’s imperative to diversify your revenue streams. Diversify your revenue streams to multiple industries, geographies and buyers. After a few years in, you cannot only sell to tech startups or financial services.

GTM leaders have to work closely with product and drive the roadmap in a way that expands the addressable market. This is a long-term play but critical.

4. Quick wins over big transformations

"Our professional-services business started to see less demand for multi-year transformations and in some cases, delayed projects as customers focus on quick wins and fast time-to-value." - Brian Millham, COO

Big, multi-year transformations is something nobody has time for in a high interest environment where patience wears thin. Buyers want value fast.

Startups can win in this case. Delivering fast time to value is key. Most startups can move faster than large companies and tailor their offerings to specific needs. GTM leaders should review how they engage post-sales team members in the sales cycle to ensure buyers get to know the team, trust is built and they can jump-start post-sales delivery.

5. Execution - maximise rigour

"Customers are continuing to scrutinize every deal." - Marc Benioff, CEO

Customers do what they do as a result of the environment. There’s little sellers can do about it. What you can do is maximise rigour. Leaders can lead by example, running highly effective 1:1s and tight forecast calls.

Drive strong adherence to the process and inspect every deal. Ask reps where they need support. Check against all angles and bring it to other team members to increase the chances of success. It's a team sport.

If you need a demo, bring in the SE, prepare and execute. The same goes for the CSM or an exec sponsor on the deal.

Leaders will struggle to strike the tough balance of covering every angle vs micro-managing. I don’t know the magic formula except for transparent communication. The reason leaders are deep in deals is not because of distrust. It’s because of the importance of every single deal. It’s all about helping the rep and the company be successful.

Increase rigour and urgency wherever possible.

6. Control the controllable

"While the economy is not under our control, our margins are.” - Marc Benioff, CEO

Everyone in Saas and B2B sales should take this to heart. Benioff said it, you should control what you can control. Reps focus on the process and what you sell. SEs focus on showing value, product and problem-solving. CSMs on supporting value realisation ... everyone plays their part.

It will not be easy in SaaS for the next few quarters. In particular, startups will have difficulty hitting their number, retaining revenue and keeping morale high.

We’re in a very tough period, and it’s better to accept that and do the best work possible than to throw in the towel.

TL;DR - Salesforce CRM 0.00%↑ Earnings

Key points for SaaS professionals from Salesforce Q1 earnings.

Growth in 2023 - It's all relative

Competition - Stay paranoid

Macro & Diversification

Quick wins over big transformations

Execution - maximise rigour

Control the controllable

🔎 Other Quotes from Salesforce’s Q1 Earnings

On AI and GPT

Every CEO I've spoken with sees AI as a revolution beginning and ending with the customer. And every CIO I've spoken with wants more productivity, more automation and more intelligence through using AI

👉 My take: AI is coming for B2B tech. Don’t get blinded by the wave of AI noise on social. There’s real appetite and real change coming.

On Sales Cycles

we see elongated deal cycles and deal compression, particularly in our more transactional revenue streams like SMB, create and close and self-serve.

It really is the velocity business that has held us back a bit on our crate and close some of the SMB

👉 My take: Volatility in small businesses and startups continues to put pressure on GTM leaders.

On Enablement

Enablement being an important strategy for us as we saw during the pandemic, not as many of our AEs and SEs and leaders were as enabled as we would like. We've made those changes, and we've really invested in the time to make sure our AEs understand our product portfolio

👉 My take: Enablement is key to win, especially in ever-expanding product portfolios, an evolving competitive landscape and changing buyer needs.

On Sam Altman & Open AI

But I think it started to occur to me -- I think folks know, I have -- my neighbor is Sam Altman is the CEO of Open AI, and I went over to his house for dinner, and it was a great conversation as it always is with him.

And he had -- he said, "Oh, just hold on one second, Marc, I want to get my laptop." And he brought his laptop out and give me some demonstrations of advanced technologies that are not appropriate for the call.

👉 My take: I need to start talking more to my neighbours.

🚀 Startups

🔗 Link: How Intercom navigated the AI paradigm shift

🔗 Link: How much should startup CEOs make? via

🔗 Link: Even Sequoia made mistakes. Startup exits are really hard.

🔗 Link: Startup success is hard. Like ridiculously hard.

🔗 Link: Mass extinction coming for startups?

🔁 SaaS

🔗 Link: The best thread on Stock-Based Compensation.

🔗 Link: Shameless plug. I did a podcast on global expansion. Check it out.

💰 Sales

🔗 Link: CRO of Calendly on AI in Sales

🔗 Link: Speed > Accuracy. Any day. Great post by Sam Jacobs of Pavillion.

🔗 Link: 3 mistakes sales teams make and get stuck in POC and how to avoid them.

👋 Parting thought

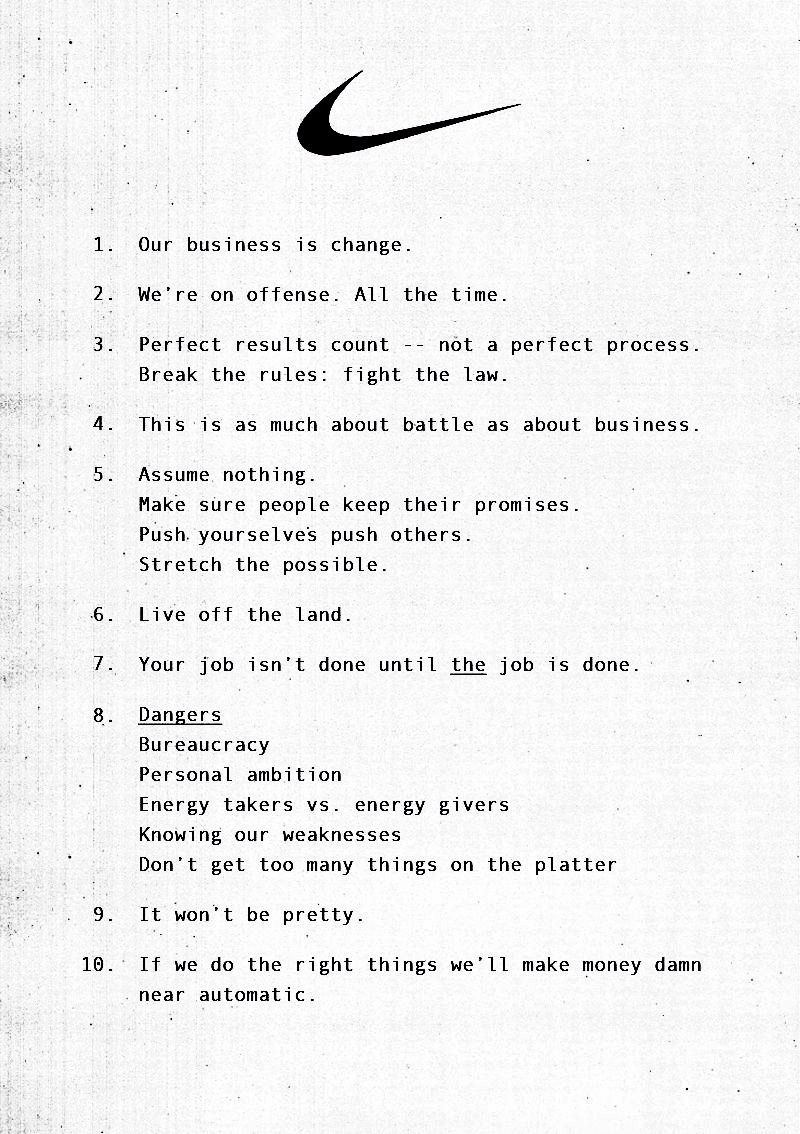

🔗 Link: Nike principles should be every startup's principles.

❤️ Enjoyed this? Here’s what you can do.

🙏 Thank you for reading!

🔔 Interested in more? Follow me on LinkedIn.

✅ If you haven’t already, subscribe to morevalue.substack.com.

⚙️ Want to work with me? Reply to this email or visit www.semirjahic.com

🙏 That’s it. Have a great Sunday!