MV #030: 🙏 A little prayer for end of quarter

A little prayer for end of quarter and what the state of SaaS means for reps.

👋 I'm Semir, and I write More Value to help my readers get smarter on (1) startup-building, (2) B2B SaaS and (3) Go-To-Market (especially Sales). No fluff. All value. Subscribe now!

👋 Hi SaaS people!

After a whirlwind parental leave and juggling a gazillion things (yup, I've counted), I had to hit pause on my newsletter. But here we are, making a comeback! I will do my best to get back on schedule now!

Alright, enough whining.

Where are we? It's Q3's end, a time when sales reps juggle between finalizing deals and trick-or-treating with their kids.

Life is a real struggle for SaaS sales reps this Q3. Most SaaS companies seem to end Q3 on 31 October. If you’re already in Q4, you will still find this insightful.

If you’re a rep and you don’t close out a strong Q3, things just pile up even more in Q4. It’s as much a nightmare as the new Scream movie (yep, there is a new Scream movie).

Hitting quota has been challenging for thousands of reps in SaaS. Like, really challenging.

Many tech CEOs promised (or hoped) it would get better towards the end of the year. Has it? No. We’re nowhere near the good old times and we won’t get there anytime soon.

A quick peek at layoffs.fyi suggests an unsettling trend. Layoffs are up again! Every company is in planning mode for 2024. Executives are assessing where they are. How much cash they have left? What is truly needed next year? What strategic goals are a priority?

There's a growing realisation about the urgency for rightsizing to maintain costs and align with market demands. Meaning, more layoffs to come and less hiring in 2024.

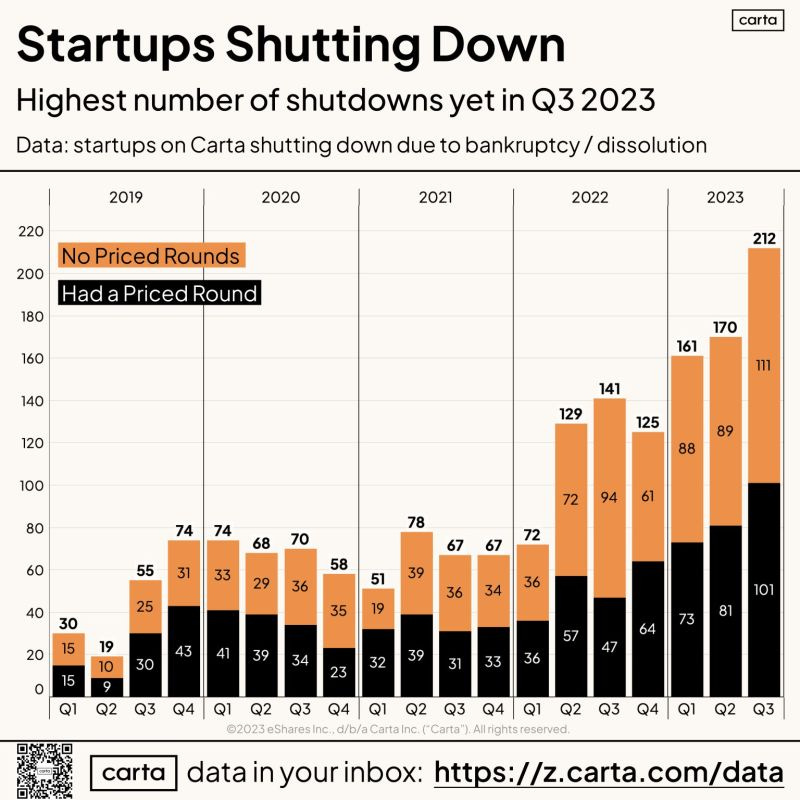

Recall those startups, beneficiaries of the zero-interest-rate era, that had secured massive funding? The clock's ticking for them. If they haven't nailed their product-market-fit post their 2021 windfall, some serious introspection is in order.

Money solves a lot of problems but if you can’t scale beyond your initial few customers, beyond your first industry, beyond your first geography, you have a real problem.

Tick, tack…

What about me?

So, how are things looking out there?

For those curious about the broader sales landscape, Lightspeed has some numbers that might raise eyebrows. In their report the surveyed 143 startups.

Out of 143 startups surveyed, a whopping 63% couldn’t meet their revenue targets. An alarming one in three even missed their mark by over 21%. If you've been grappling with your quotas, trust me, you've got company.

But if you've hit them, a virtual high-five to you!

But remember: Software is not the "REAL ECONOMY”

As the tech sector is recalibrating from its free-spending spree of 2021-2022, it's reassuring to note that outside our tech bubble, the scenario seems much better.

The US economy grew by 4.5% and unemployment is only at 3.8%. People have jobs and the economy is growing. Even earnings are not that bad. Most companies have performed quite well so far in the earnings season.

Though the stock market's fluctuations might not mirror this growth, larger macro-economic and geo-political factors are at play.

The real economy seems to be doing pretty okay.

However, in our SaaS world, there's no sidestepping the reality. Markets are oversaturated. Prices of many tools are inflated. Especially for basic SaaS tools which try to charge a premium for being a glorified spreadsheet in the cloud.

Startups have started shutting down and the trend is picking up as Carta data shows. More on this in my recent post here:

But it’s not just those companies that struggle, everyone is trying to do more with less. Even the most prominent companies are finding it hard to sell premium products in this environment.

Take OpenAI, for instance. With rising competition, especially post-Mark Zuckerberg's unveiling of open-source LLama 2, the waters have become more treacherous.

The Silicon Valley darling is struggling - OpenAI’s competition

It turns out OpenAI is struggling too. Here’s insight from an article by the Information.

Some of those firms are paying for similar AI from competing providers that claim they can help the firms use AI more cheaply. Other customers are beginning to buy OpenAI’s software through Microsoft because they can bundle the purchase with other products.

Microsoft's strategic advantage stems from its unparalleled distribution network, an enviable reputation of trust, and the power to integrate seamlessly with its diverse product suite.

The revenue-sharing agreement with OpenAI could be quite good for MSFT 0.00%↑ but not so good for OpenAI because of exactly that.

Moreover, OpenAI's dominance in the generative AI and LLM space is being challenged. The game changed when Mark Zuckerberg unveiled the open-source LLama 2, intensifying competition considerably.

How should startups, especially early-stage ones think about this?

The way they can build products is super easy using the tools of OpenAI. Founders might start using OpenAI for fast prototyping. But they should consider moving to a cheaper, open-source model that you have more control over.

This was nicely pointed out here by

author of the amazing State of AI report.With the competitive landscape evolving rapidly, there are genuine concerns about whether OpenAI's valuation can withstand the market pressures from all these angles.

Personally, I’m not sure OpenAI’s lofty valuation will hold up.

Where does all this leave SaaS revenue teams?

If you’re doing well, stay put.

You’re selling something that people want and are willing to pay for. Don’t run after the latest hype at this point.

If you are struggling to hit quota, honestly assess the situation.

Scenario 1: It’s not the market, it’s you

Is it your skillset? That’s easy. You can work on yourself. Learn, adapt and change the way you operate to succeed. We all must be learning machines in this economy. This is something fully in your control.

Scenario 2: Your company lacks product-market-fit

Is it the product-market-fit? Is your company selling something that has not truly reached PMF and made a lot of its money thanks to an expensive acquisition strategy without long-term stickiness and value?

That’s much harder to fix. Especially if you’re just part of the sales team. You can’t change the market or the product. And definitely not in time to hit your number. Then it’s time to think about where can you succeed.

Scenario 3: You’re already looking…

Are you looking already because you’re part of an unfortunate restructuring?

Do heavy due diligence on the company that you are evaluating to join. Ask all the hard questions and compare your company against its peers.

If it’s a public company, that’s quite easy. And at this point joining Salesforce or Microsoft is probably a pretty good option.

If you’re thinking of joining a recently-IPO’ed or pre-IPO company go through the metrics. Follow people like Jamin Ball from

to learn what good looks like.Finally, if none of this excites you, think about starting your own company or join a super-early, promising company where you can grow as a person and professional.

Times are tough in SaaS but there’s always a place somewhere where you can do well, feel good and have fun doing what you do.

👋 Parting thought

No matter where you are in the tech world, focus on the things you can control, accept the things you cannot change, and learn to see the difference. Here’s my take on the famous prayer of serenity.

❤️ Enjoyed this? Here’s what you can do.

🔔 Follow me on LinkedIn.

✅ If you haven’t already, subscribe to morevalue.substack.com.

⚙️ Want to work with me? Reply to this email or visit www.semirjahic.com

🙏 That’s it. Have a great Sunday and see you in August!

Join 100s of SaaS professionals get smarter on startup-building and sales.