MV #029: Salesforce Q2 Earnings Highlights for SaaS Leaders

Salesforce Crushed Q2 - here are the highlights from the earnings call and what it means for SaaS leaders going into the rest of the year.

👋 I'm Semir, and I write More Value to help my readers get smarter on (1) startup-building, (2) B2B SaaS and (3) Go-To-Market (especially Sales). No fluff. All value. Every other Sunday.

👋 Hi People

The summer is coming to a slow end and I hope you are recharged for what will be an exciting second half of the (fiscal) year.

In case you missed it, Twitter is now X, we almost achieved super-conductivity and apparently, you should have watched either Barbie or Oppenheimer. On the macro side, the economy is stabilising but we still see high interest rates and sticky inflation which will remain for quite a while.

So, this is the new normal.

What’s new in SaaS?

In the world of SaaS, things are also more stable. Some companies are finding their feet in this new normal. Heck, we might even see the first pure software IPO in years with Klavyio. Exciting!

When I think about SaaS, I always think about Salesforce CRM 0.00%↑. The OG of SaaS. Every earnings call gives me a good pulse on enterprise SaaS as a whole. So, as always, I listened to the last earnings call and their Q2 has been a massive success.

Great results. Increased efficiency. Reduced cost. Beat estimates.

A few highlights:

🤜 Beat Earnings per share: $1.90 right ➡️ $2.12.

🤜 Beat Revenue: $8.53bn ➡️ $8.6bn.

🆙 Raised FCF by 1%.

🆙 Raised Margin guidance for FY24.

🆙 Raised revenue guidance by a cool $100m for FY24.

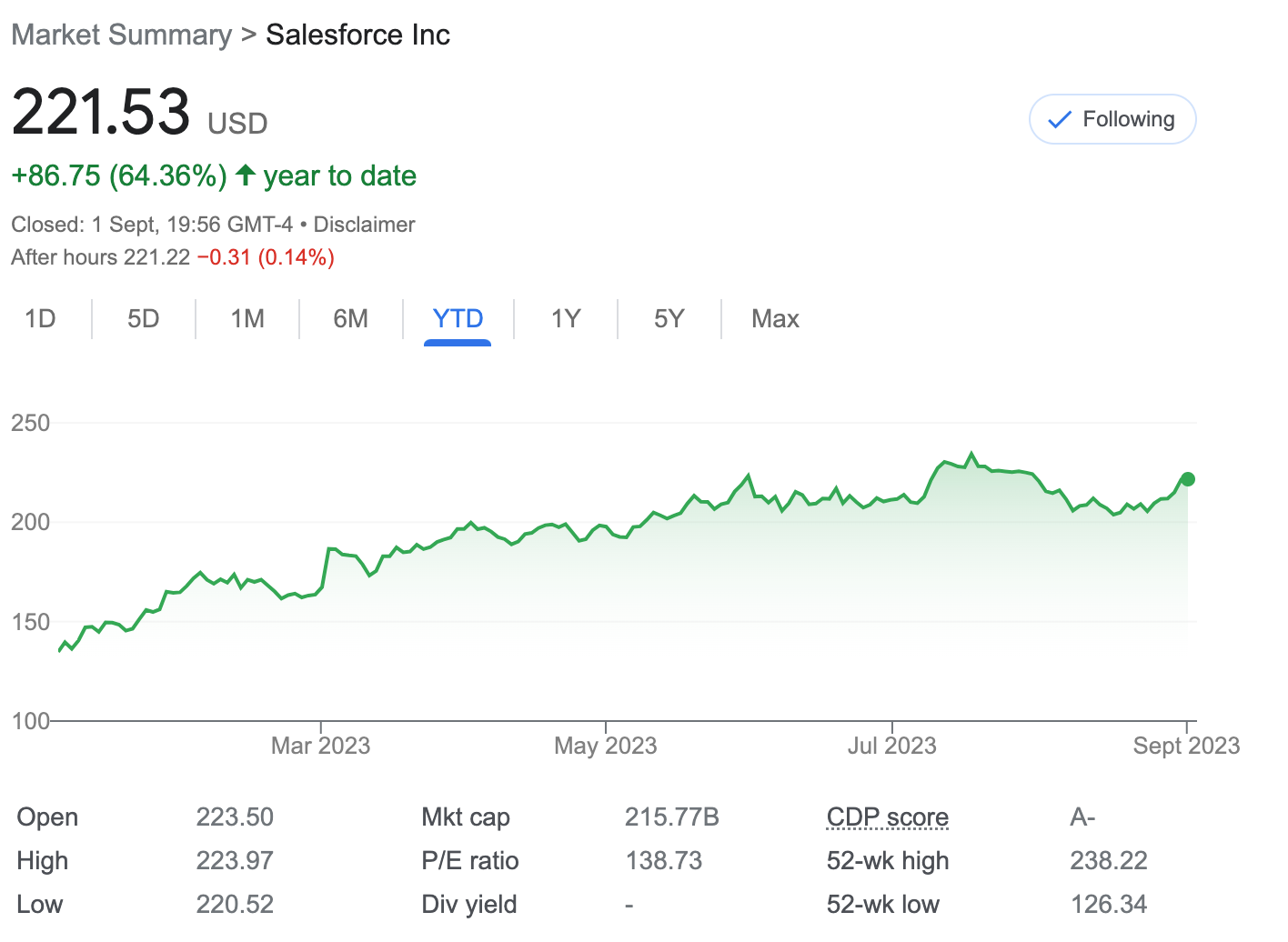

The results show clearly that Marc Benioff has been able to turn the tanker around. He also scared away activist investors and is taking full advantage of the AI hype to grow his $30bn ARR business. Kudos to the Salesforce team for this amazing turnaround. Investors clearly like where things are going with CRM 0.00%↑ up almost 65% this year.

I listened to the earnings call for Salesforce’s Q2 and captured a few key quotes from the leadership that tell us a lot about the state of SaaS.

Enjoy!

On AI

So every CEO I've met with this year across every industry believes that AI is essential to improving both their top and bottom line, but especially their productivity. - Marc Benioff, CEO

👉 My take: No surprise here. Growth-at-all-costs is over. This is the new normal and it’s here to stay. SaaS leaders waiting to go back on the free money train will wait for very, very long.

And we're going to see that this AI revolution is really a data revolution. - Marc Benioff, CEO

👉 My take: AI is more than just hype. Benioff calls out that data is the key ingredient to be successful with AI and I agree. No matter if you’re building foundation models or applications, data is what fuels your value engine.

We expect nonlinear quarterly margins in the back half of this year, driven by investment timing, specifically in AI-focused R&D. - Amy Weaver, CFO

👉 My take: Spend is down across the board. And yet, Salesforce managed to grow, build differentiating value and continue to impress investors. Well done! More can be done with less. It’s a strong sign of how bloated some companies have gotten in the last few years.

We're moving rapidly into the second zone that we all know is generative AI and these GPT products, which we've now released to our customers. We're very excited about the speed of our engineering organization and Salesforce Q2 FY24 Earnings Conference Call technology organization, our product organization and their ability to deliver customer value with generative AI. - Marc Benioff, CEO

👉 My take: This is a trend I see in many big companies. Incumbents have a distinct advantage thanks to their data richness against emerging competitors (read: startups).

On Sales

Amid the ongoing measured buying environment, compression of larger transformational deals continued in the quarter. - Brian Millham, COO

👉 My take: Yep, sales is still hard and it’s going to stay that way. Without proving value, excellent sales execution and end-to-end customer success, SaaS leaders won’t be able to build sustainable businesses.

In the quarter, we saw consistent demand in our core business, and we continue to benefit from customers consolidating their technology platforms to reduce complexity, drive efficiency and growth. - Brian Millham, COO

👉 My take: The ultimate consolidator is Salesforce. No matter if you’re a IPO’ed company, a late-stage startup or a seed-funded tech company. Salesforce is the biggest fish. The tougher the macro, the more consolidation will happen. This is the nature of the best and if you’re the the sphere of Salesforce - or any of the big tech companies - you absolutely have to find a way to differentiate, deliver more value and become sticky.

The measured macro environment continues to impact customer decision-making. And we are still seeing elongated sales cycles, additional deal approval layers and deal compression. - Amy Weaver, CFO

👉 My take: Sales also takes more stamina than it used to in the past couple of years. I’ve talked to many sales reps in the past few months, many of whom have only been sellers for less than five years. That generation of salespeople will have a sort of awakening to this new type of sales job that is far from easy.

On SaaS Macro

Our industry verticals continue to be a growth lever for us. And for the third consecutive quarter, eight of our industry clouds grew at ARR above 50%. - Brian Millham, COO

👉 My take: There is huge untapped potential for SaaS companies outside tech. For too long startups have been selling to friends in other startups. Now, that a downturn for those companies has kicked in, SaaS leaders should seek opportunities in other verticals. Salesforce has got that nailed. Have you?

Our focus on customer success drives our own success, accelerating revenue and profitability. - Brian Millham, COO

👉 My take: Revenue + Profitablity.

Our disciplined approach to cost management has allowed us to exceed our 30% non-GAAP margin target three quarters early. Q2 operating cash flow was $808 million, up 142% year-over-year. Q2 free cash flow was $628 million, up 379% year-over-year. - Amy Weaver, CFO

👉 My take: Look at that FCF increase. It takes a lot to move a tanker like Salesforce to adjust to the new macro. If they can do it so should any SaaS leader at their company.

International acceleration continues a big opportunity for us - Brian Millham, COO

👉 My take: SaaS penetration is pretty big in the US but elsewhere there’s a massive opportunity. International expansion - my favourite topic btw - is a key growth lever for SaaS leaders.

We're going to see the impact of our price increase really hit the customer base over the next one to two to three years. So no big material change in this fiscal year. - Brian Millham, COO

👉 My take: The magic of compounding growth with SaaS is amazing. At the same time, this is a great reminder that price hikes that time to have an impact on the bottom line.

We're not planning any other major restructuring efforts in the company today like what we saw earlier this year. We hope that, that is one and done and behind us. - Marc Benioff, CEO

👉 My take: Salesforce is done with layoffs. For now.

What’s next?

After a lot of doom and gloom, layoffs and tough times it seems that we’re through the shock and looking ahead. Salesforce has achieved a solid Q2 and serves as an indicator of what’s to come for every SaaS company. Profit + Growth. Not just Growth.

Companies that make the shift will thrive.

The rest will likely feel more pain or even fail entirely.

❤️ Enjoyed this? Here’s what you can do.

🔔 Follow me on LinkedIn.

✅ If you haven’t already, subscribe to morevalue.substack.com.

⚙️ Want to work with me? Reply to this email or visit www.semirjahic.com

🙏 That’s it. Have a great Sunday and see you in August!

Subscribed

Join 100s of SaaS professionals to get smarter on startup-building and sales.